UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No.)

Filed by the Registrant ý Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | | | | | | | | |

| ¨ | | Preliminary Proxy Statement | |

| | |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| | |

| ý | | Definitive Proxy Statement | |

| | |

| ¨ | | Definitive Additional Materials | |

| | |

| ¨ | | Soliciting Material under Rule 14a-12§240.14a-12 | 0 |

HERITAGE FINANCIAL CORPORATION

(Name of registrant as specified in its charter)

(Name of person(s) filing proxy statement, if other than the registrant)

Payment of Filing Fee (Check the appropriate box)boxes that apply):

| | | | | | | | | | | | | | |

| ý | | No fee required. |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Fee computed on table belowin exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | | Title of each class of securities to which transaction applies: |

| | (2) | | | Aggregate number of securities to which transaction applies: |

| | (3) | | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | | Proposed maximum aggregate value of transaction: |

| | (5) | | | Total fee paid: |

¨ | | Fee paid previously with preliminary materials. |

¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | | Amount Previously Paid: |

| | (2) | | | Form, Schedule or Registration Statement No.: |

| | (3) | | | Filing Party: |

| | (4) | | | Date Filed: |

March 19, 202122, 2024

Dear Shareholder:

On behalf of the Board of Directors and management of Heritage Financial Corporation, we cordially invite you to attend the annual meeting of shareholders. The meeting will be heldconducted solely online via live webcast at 9:00 a.m., Pacific Time, on Tuesday,Monday, May 4, 2021. Due to continuing concerns regarding the COVID-19 pandemic and to protect the safety and well-being of our shareholders, directors and employees, our 2021 annual meeting of shareholders will be a virtual meeting conducted solely online via live webcast.6, 2024. There is no physical location for the annual meeting. You will be able to attend the virtual annual meeting, submit questions and vote online by logging on to www.meetingcenter.io/241594936www.meetnow.global/MGGV9A7using yourthe unique control number that has been provided with the Notice Regarding the Availability of Proxy Materials or on your Proxy Card. The password for the meeting is HFWA2021.Materials. The matters expected to be acted upon at the meeting are described in the attached Proxy Statement. In addition, we will report on our results of operations during the past year and address your questions and comments.

We encourage you to attend the virtual annual meeting. Whether or not you plan to attend the virtual annual meeting, please take the time to read the Proxy Statement and vote via the Internet or telephone or by completing and mailing a proxy card as promptly as possible. This will save us the additional expense of soliciting proxies and will ensure that your shares are represented at the annual meeting.

Your Board of Directors and management are committed to the continued success of Heritage Financial Corporation and the enhancement of your investment. We appreciate your confidence and support and look forward to seeing youyour attendance at the virtual annual meeting.

| | | | | | | | |

| | |

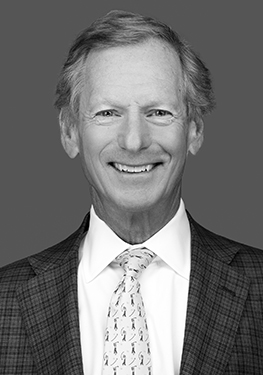

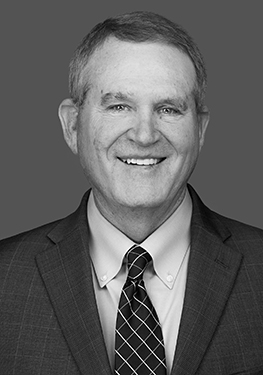

| Brian L. Vance | | Jeffrey J. Deuel |

Chairman of the Board Chair | | President and Chief Executive Officer |

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

| | | | | | | | |

| Date: | | | | | | | | Monday, May 6, 2024 |

| | Date: | Tuesday, May 4, 2021

| Time: | | |

| Time: | 9:00 a.m., Pacific Time |

| | |

| Place: | Place: | Virtual Shareholders' Meeting |

| | www.meetingcenter.io/241594936 |

| | Meeting password is HFWA2021 - www.meetnow.global/MGGV9A7 |

Matters to be Voted On:

1.The election of eleventen directors to each serve for a one-year term.

2.An advisory (non-binding) resolutionvote to approve the compensation paid to our named executive officers, as disclosed in the Proxy Statement.officers.

3.The ratification of the Audit and Finance Committee’s appointment of Crowe LLP as our independent registered public accounting firm for the year ending December 31, 2021.2024.

We will also transact other business that may properly come before the meeting, or any adjournment or postponement thereof.

Shareholders of record at the close of business on March 8, 202111, 2024 are entitled to receive notice of and to vote at the annual meeting. Shareholders who vote by proxy do not need to participate in the annual shareholders' meeting.meeting as a "Shareholder" and may simply access the meeting as a "Guest." However, any shareholder who wishes to participate in the virtual meeting should follow the instructions below to access the meeting at www.meetingcenter.io/241594936 with the following meeting password: HFWA2021.www.meetnow.global/MGGV9A7.

Registered Shareholders: If your shares are registered directly in your name with Computershare Inc., our stock transfer agent, you are considered the shareholder of record with respect to those shares. Shareholders of record may participate in the meeting as a "Shareholder" or as a "Guest." If you participate as a Shareholder, you will be able to participate in the meeting as if attending in person, including the ability to vote your shares and ask questions of management during the virtual meeting. Voting instructions will be provided on the meeting website during the meeting. To join as a Shareholder, you will need the control number provided with the Notice Regarding the Availability of Proxy Materials or on your proxy card.Materials.

Beneficial Owners of Shares Held in Street Name: If you hold your shares through an intermediary, such as a bank or broker, you must register in advance to fully participate in the meeting. You may participate as a Guest without having a unique control number, but you will not have the option to vote your shares or ask questions atduring the virtual meeting. To fully participate in the meeting as a "Shareholder","Shareholder," you must obtain a unique control number by registering in advance with Computershare. See the section titled, "What if My Shares Are Held in Street Name by a Broker?" for further instructions.

Please also refer to the instructions on the Notice of Internet Availability of Proxy Materials you received in the mail. You can request to receive proxy materials by mail or e-mail. Promptly voting your shares via the Internet, by telephone, or by signing, dating, and returning thea proxy card, which is solicited by the Board of Directors, will save us the expense and extra work for additional solicitation. The proxy will not be used if you attend and vote at the virtual annual meeting. Please vote your shares at your earliest convenience. Your vote is very important and this will ensure the presence of a quorum at the meeting.

| | |

| By Order of the Board of Directors, |

|

| Kaylene M. Lahn, Corporate Secretary |

| Olympia, Washington |

March 19, 202122, 2024 |

PROXY SUMMARY

This summary highlights information contained elsewhere in the Proxy Statement. This summary provides an overview and is not intended to contain all the information that you should consider before voting. We encourage you to read the entire Proxy Statement for more detailed information on each topic prior to casting your vote.

20212024 Annual Meeting of Shareholders

| | | | | | | | | | | | | | |

DATE: | | TIME: | | PLACE: |

Tuesday,Monday, May 4, 20216, 2024 | | 9:00 a.m., Pacific Time | | Virtual ShareholderShareholders' Meeting |

Voting Matters and Board Recommendations

| | | Proposal | |

| Proposal | |

| Proposal | |

| Proposal | |

| Proposal | |

| Proposal | Proposal | Board

Recommendation | Page | Board

Recommendation | Page |

| 1 | 1 | The election of eleven directors to each serve for a one-year term. | FOR each nominee | | 1 | The election of ten directors to each serve for a one-year term. | FOR each nominee | |

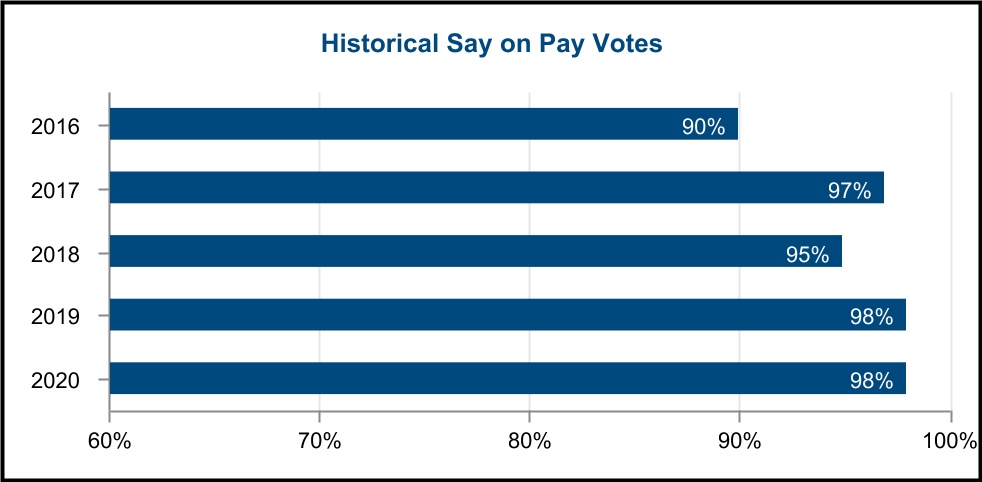

| 2 | 2 | An advisory (non-binding) resolution to approve the compensation paid to our named executive officers, as disclosed in this Proxy Statement. | FOR | | 2 | An advisory (non-binding) vote to approve the compensation paid to our named executive officers. | FOR | 26 |

| 3 | 3 | The ratification of the Audit and Finance Committee’s appointment of Crowe LLP as our independent registered public accounting firm for the year ending December 31, 2021. | FOR | 45 | 3 | The ratification of the Audit and Finance Committee’s appointment of Crowe LLP as our independent registered public accounting firm for the year ending December 31, 2024. | FOR | |

Director Nominees

| | | Committee Membership |

| | | | Committee Membership | |

| | | | Committee Membership | |

| | | | Committee Membership | |

| | Name | Name | Age | Director

since | Independent | Audit

and

Finance | Compensation | Nominating and Governance | Risk |

| Name | |

| Name | | Age(1) | Director

since | Independent | Audit & Finance | Compensation | Corporate Governance & Nominating | Risk & Technology |

| Brian S. Charneski | Brian S. Charneski | 59 | 2000 | ✓ | |

| John A. Clees | 73 | 2005 | ✓ | | ✓ | Chair |

| Jeffrey J. Deuel | Jeffrey J. Deuel | 62 | 2019 | | ✓ |

| Jeffrey J. Deuel | |

| Jeffrey J. Deuel | | 65 | 2019 | | | | | ✓ |

| Trevor D. Dryer | | Trevor D. Dryer | 45 | 2022 | ✓ | | | ✓ |

| Kimberly T. Ellwanger | Kimberly T. Ellwanger | 61 | 2006 | ✓ | | ✓ | Chair | |

| Deborah J. Gavin | Deborah J. Gavin | 64 | 2013 | ✓ | Chair | | ✓ |

| Deborah J. Gavin | |

| Deborah J. Gavin | | 67 | 2013 | ✓ | ✓ | | | ✓ |

| Gail B. Giacobbe | | Gail B. Giacobbe | 55 | 2022 | ✓ | | ✓ |

| Jeffrey S. Lyon | Jeffrey S. Lyon | 68 | 2001 | ✓ | ✓ | |

| Gragg E. Miller | 69 | 2009 | ✓ | | ✓ |

| Anthony B. Pickering | 73 | 1996 | ✓ | | ✓ | |

| Frederick ("Fred") B. Rivera | 52 | 2020 | ✓ | | ✓ | | ✓ |

| Frederick B. Rivera | |

| Frederick B. Rivera | |

| Frederick B. Rivera | |

| Brian L. Vance | |

| Brian L. Vance | |

| Brian L. Vance | Brian L. Vance | 66 | 2002 | | ✓ | 69 | 2002 | ✓ | | | | Chair |

| Ann Watson | Ann Watson | 59 | 2012 | ✓ | | Chair | ✓ | |

(1) As of December 31, 2023.

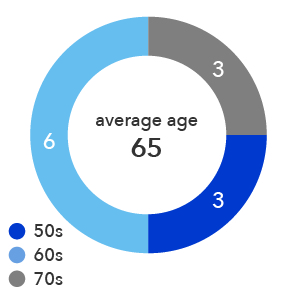

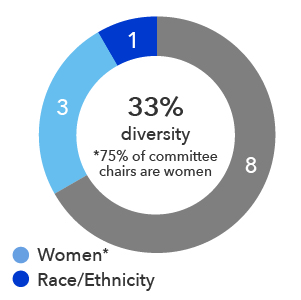

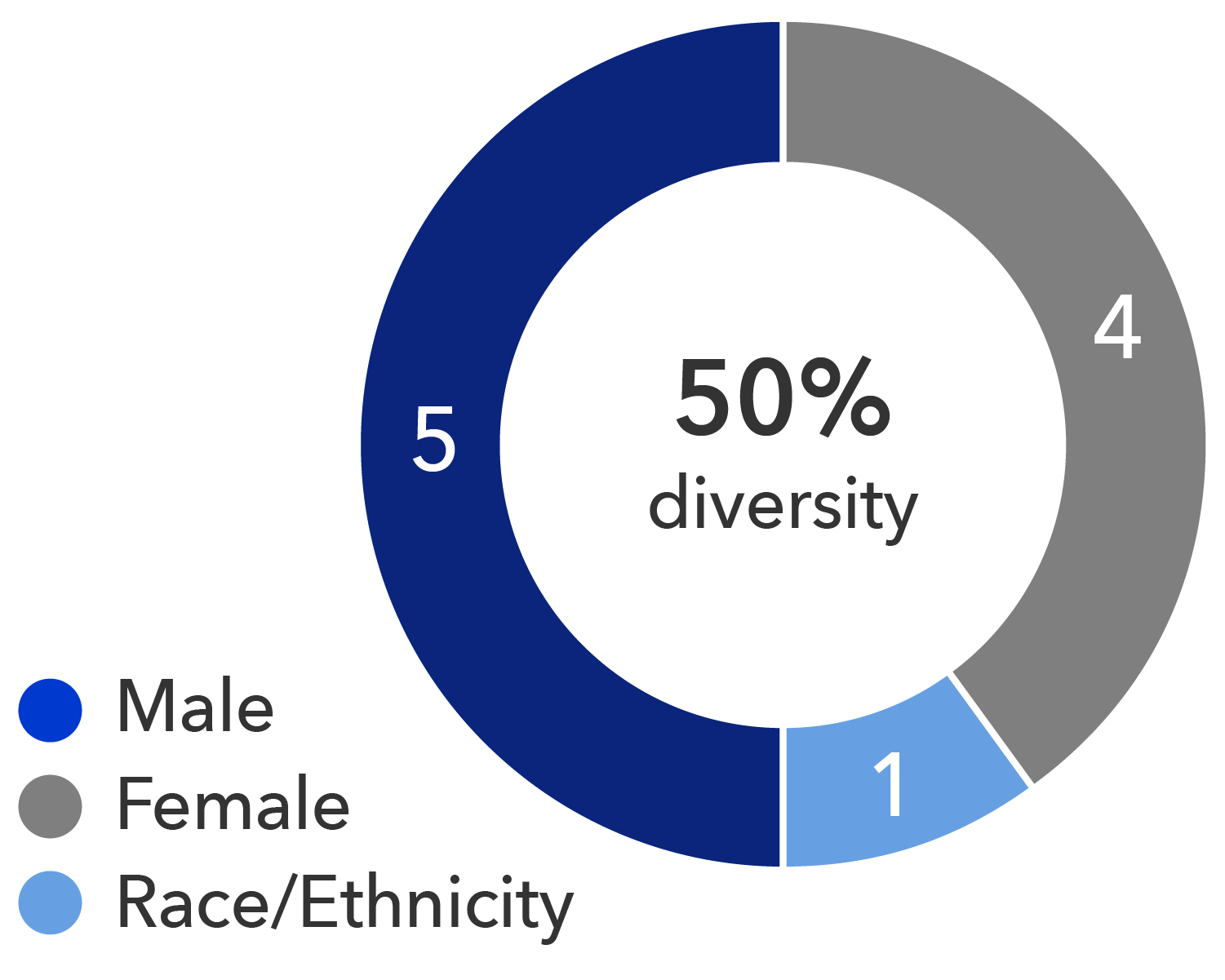

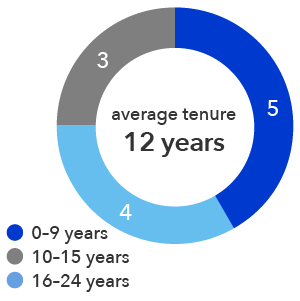

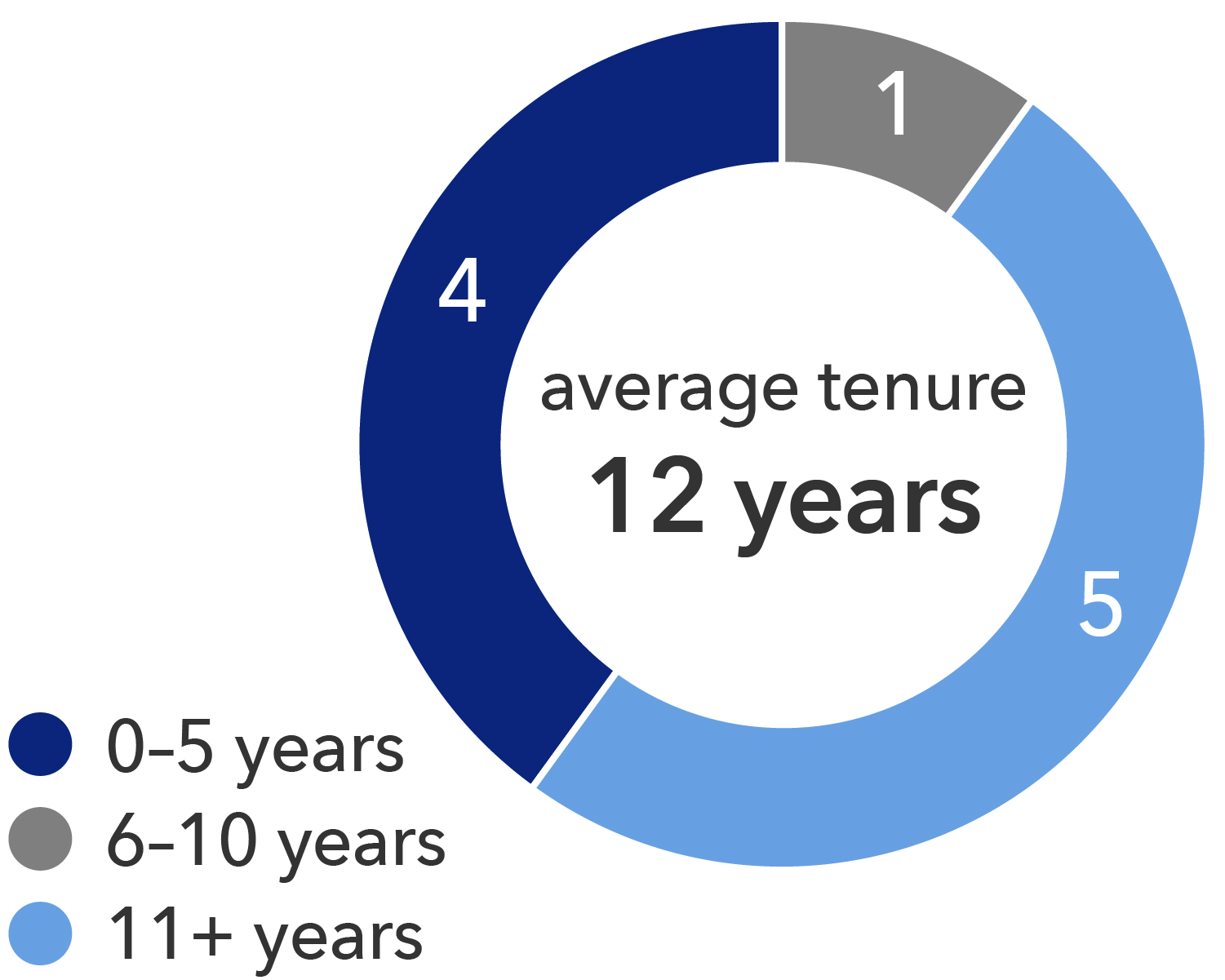

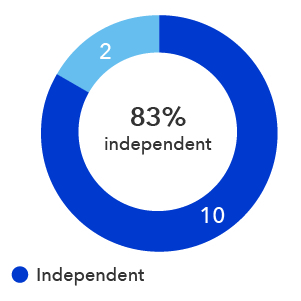

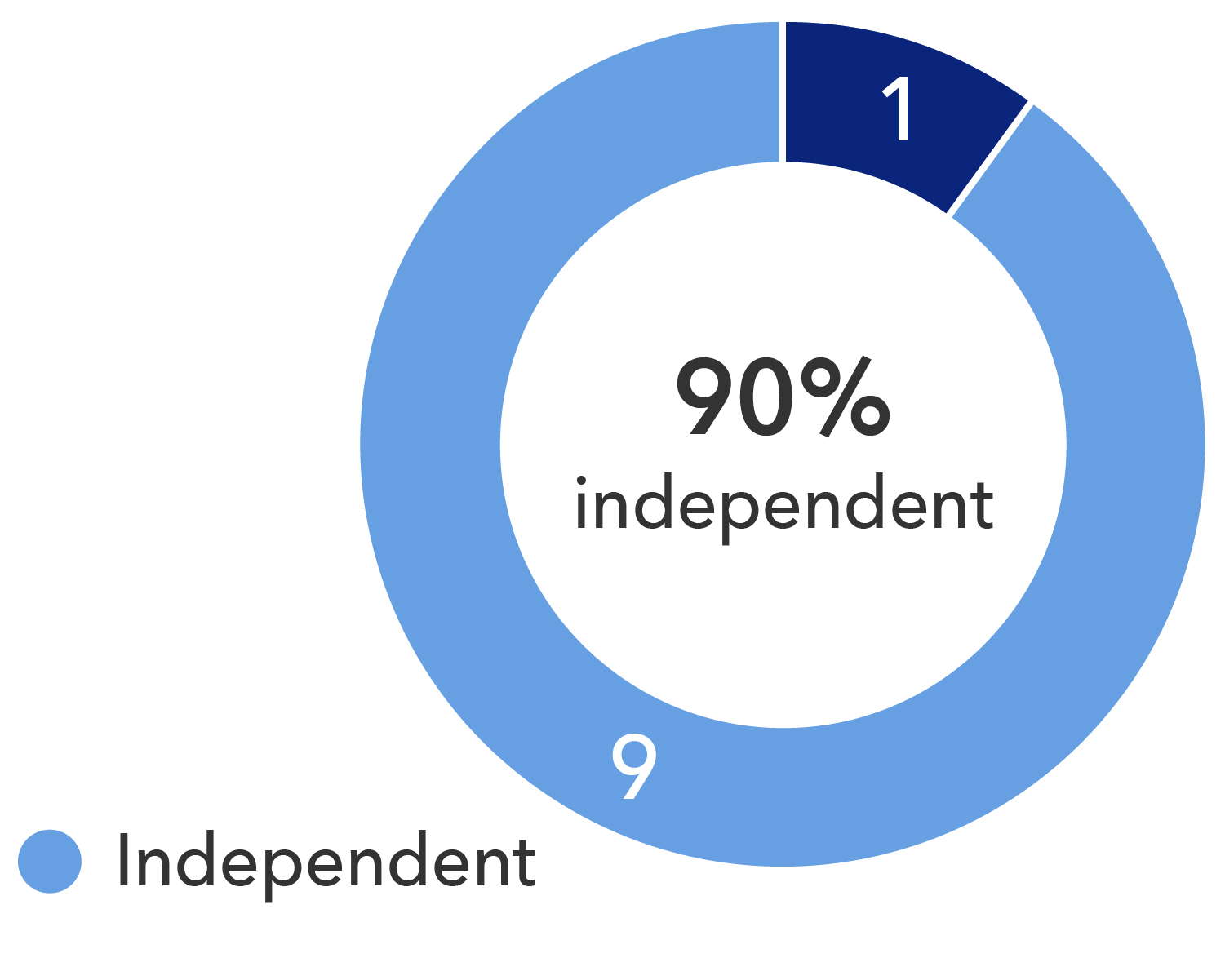

2020Board Structure

The Heritage Board of Directors is well balanced with a diverse set of skills, backgrounds, ethnicity and gender.

•Average Age: 62 years - directors may not stand for election after reaching age 75

•Diversity: 50% - 4 directors with gender diversity and 1 director with ethnic diversity

•Average Tenure: 12 years - 4 of 10 directors have served on the board for less than five years

•Independence: 90% - 9 of 10 directors are independent

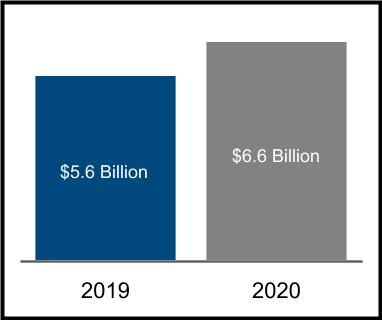

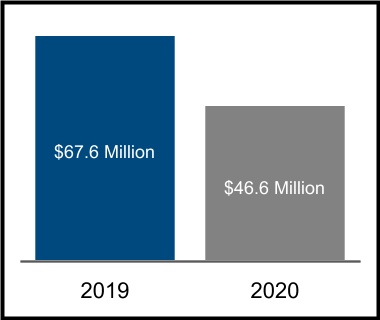

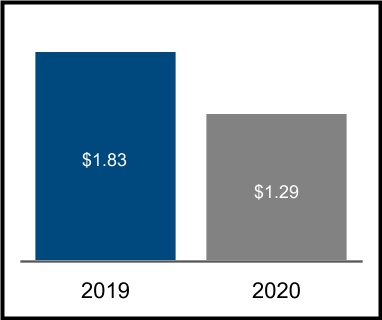

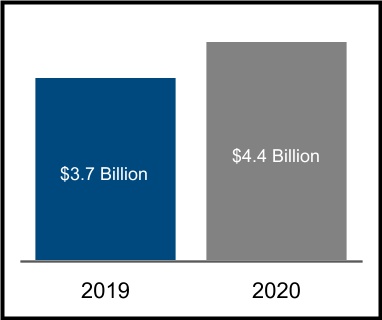

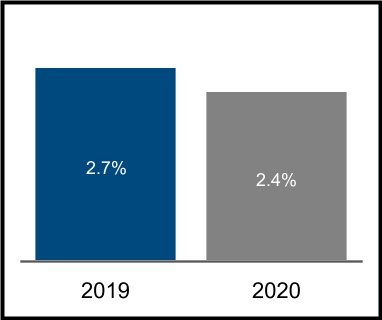

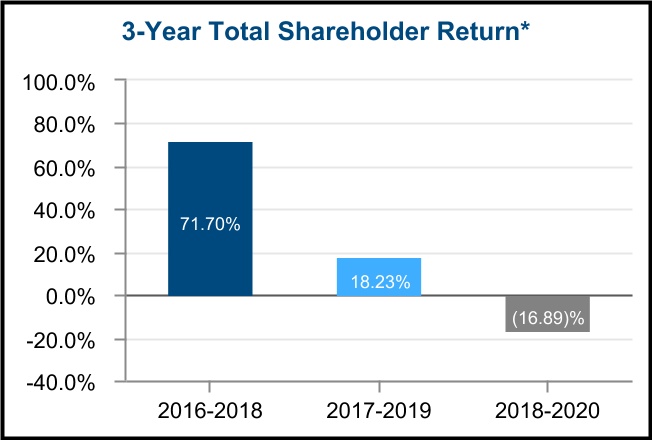

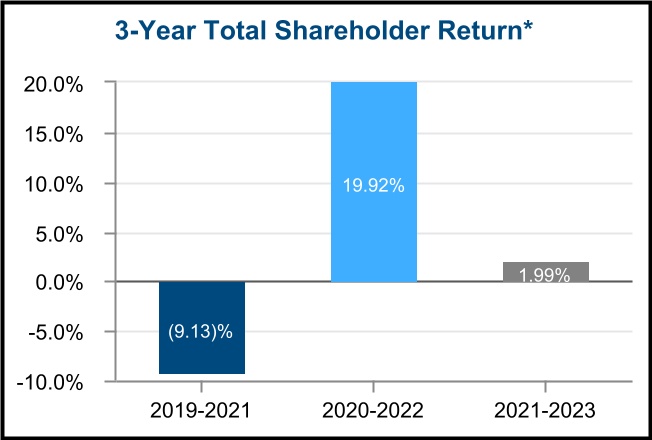

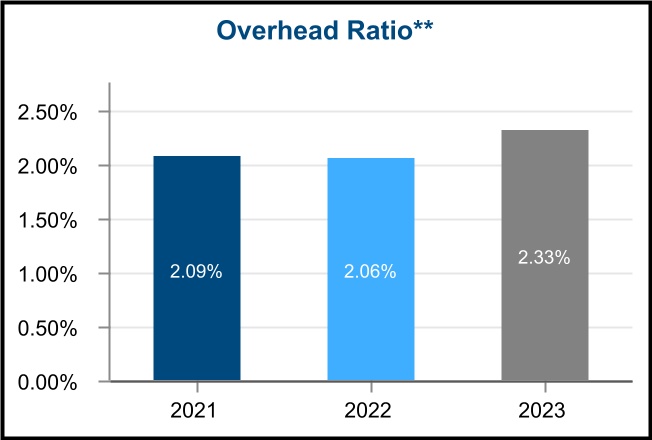

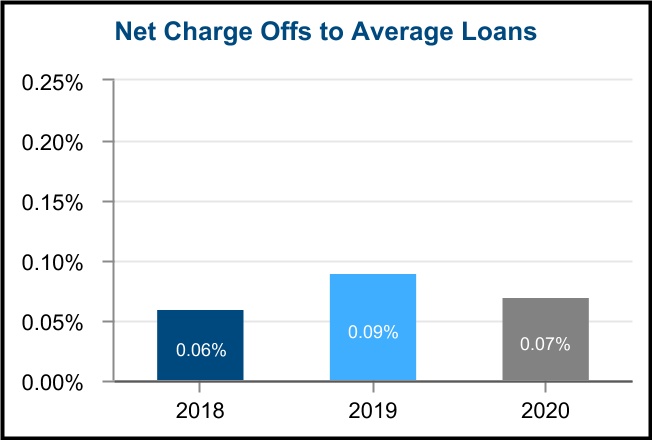

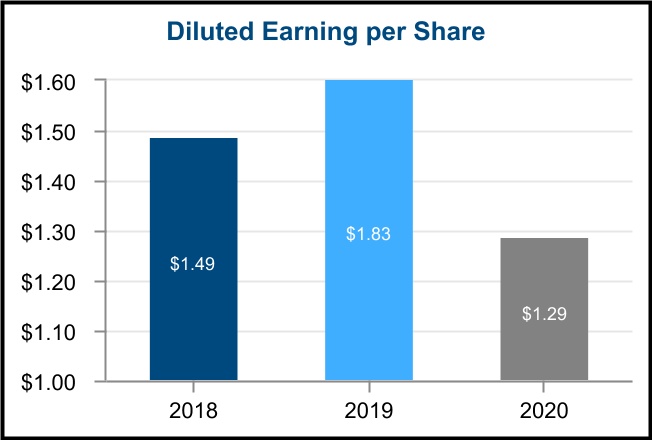

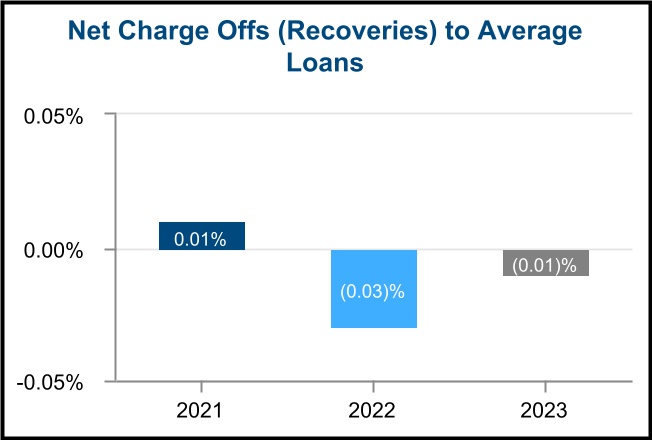

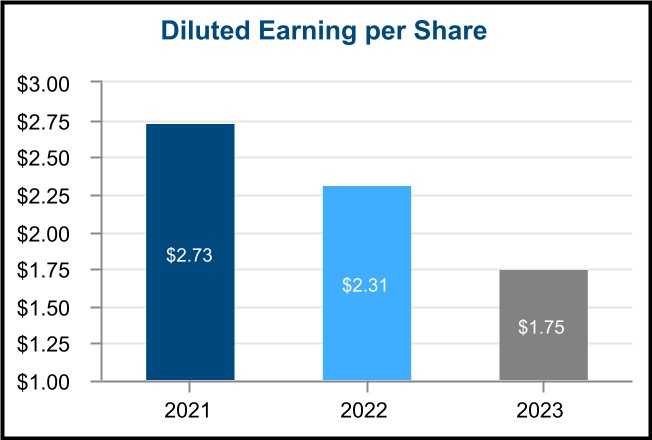

2023 Business Highlights

Although 2020 proved to be a challenging year, the Heritage team partnered with its customers and employees to help them manage through2023 was a difficult time.year in the banking industry due to rising interest rates, a broader contraction in market liquidity, and increased reliance on wholesale funding due to competition for deposits, which negatively impacted net interest margins. During the first quarter of 2023, the banking industry experienced significant challenges resulting in a series of bank failures. Heritage employees' safety, healthwas not immune to decreased deposits with higher cost of deposits due to customers seeking higher interest rates and wellness ismoving balances to higher yielding investments. At Heritage, we grew total assets and loans, and restructured the balance sheet by reinvesting in higher yielding investments. As a top priority. Employees were ableresult of the balance sheet restructure, the 2023 pre-tax net income was reduced by a $12.2 million loss on sale of securities. Heritage managed noninterest expenses by reducing full-time equivalent (FTE) employees, closing the mortgage business line, and revisiting the organization's staffing structure. Additionally, management renegotiated a core systems contract which will reduce costs in future years. Management continues to work remotely or proper safety measures were implemented within our branch locations. Manyclosely monitor credit quality, which resulted in annual 2023 net recoveries on loans to average loans of 0.01%. Heritage customers were provided accommodations such as fee waivers, loan modifications and early certificate of deposit withdrawals. We accelerated our technology platform to enhance digital services and foster the Small Business Administration's Paycheck Protection Program, serving customer's in need of loans.

In addition to the challenges created by the COVID-19 pandemic, Heritageremains focused on the following strategic initiatives: (1) relationship growth; (2) developing an integrated platform; and (3) internal communications strategy. These initiatives required disciplined attention from all levels of leadership throughout the year, without losing focus on achieving organic growth goals,balance sheet management, improving operational efficiencies, reducing expenses, maintaining sound credit quality, and smart capital and balance sheet management. Inproactively managing capital.

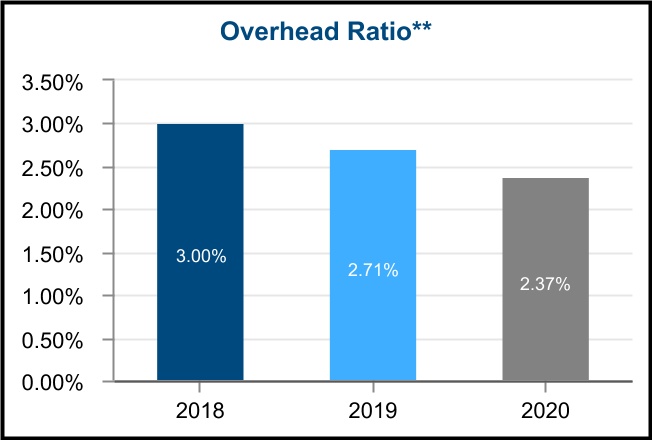

Financial summary Heritage pivoted rapidly to the changing demands from the pandemic while remaining focused on its core business fundamentals, as demonstratedresults are shown below:

| | | | | | | | | | | | | | | | | |

Total Assets | | Net Income | | Diluted Earnings Per Share | |

| | | | | | | | | | | | | | | | | |

Total Loans, Net | | Total Deposits | | Overhead Ratio (1)

| |

(1) Non-interest"Overhead Ratio" equals Heritage's non-interest expense divided by its average assetsassets. This includes the contract negotiation fee of $1.5 million, which impacted the ratio by 2 basis points for incentive payments.

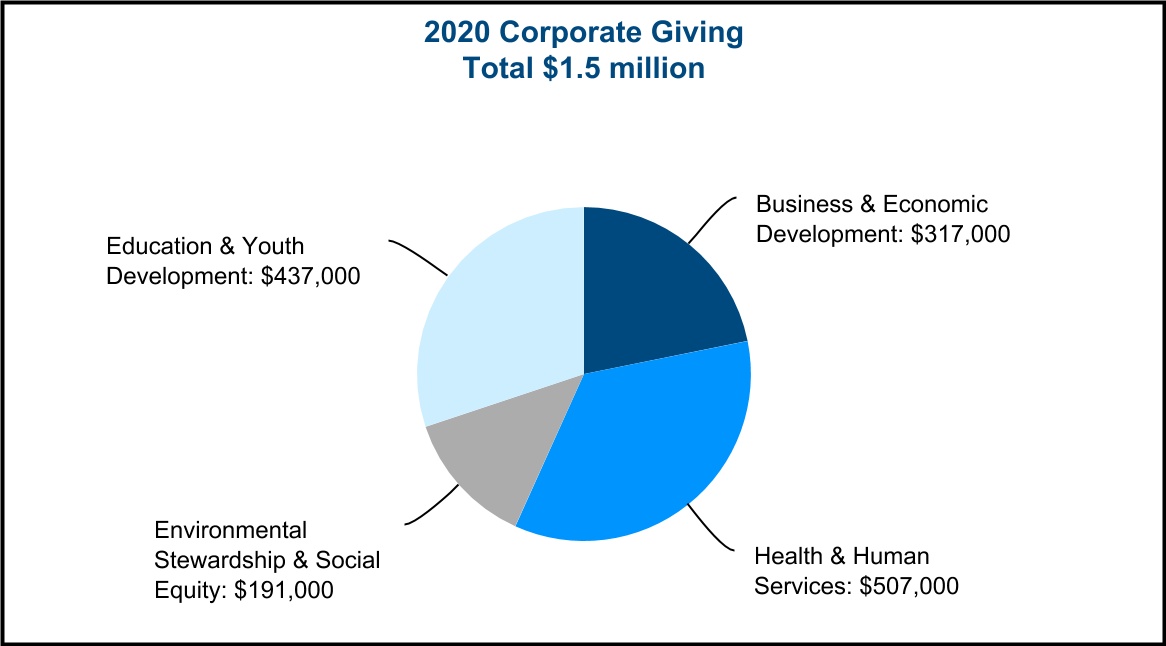

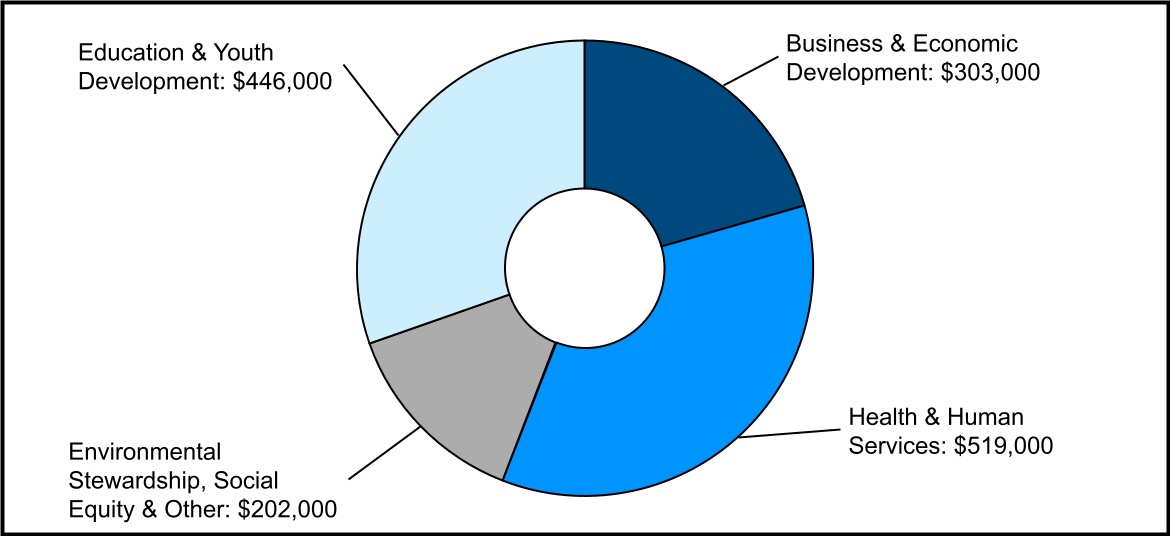

Corporate ResponsibilityEnvironmental, Social and Governance Practices

At Heritage, we are committed to environmental and sustainability efforts,practices, our human capital, ouremployees and customers, and strengthening the communities and markets in which we operate, and serving our business.shareholders. We proactively manage corporate governance and effective board oversight. We place a high priority on operating in a responsible and respectful manner and are continually focused on improving environmental, social and governance ("ESG") best practices throughout the organization. During 2020,We use the Sustainability Accounting Standards Board ("SASB") commercial bank framework to identify material risks and the associated management practices, and to further develop our ESG platform and disclosures. Annually, we developedissue to our corporate website the SASB Report and the Community Investment Report, which capture a Diversity, Equity and Inclusion ("DEI") plan, a DEI statement, a DEI Council and appointed a DEI Officer. At Heritage, we believe that our differences make us stronger. The following DEI statement captures the essencevariety of our culture:

We are committed to a culture of respect. We are defined by the combined life experiences of our teamESG and we are dedicated to fostering and cultivating an environment of diversity and inclusion. By celebrating and embracing our differences, we become stronger as an organization. We are then better able to support and represent the communities we serve.general community giving practices.

TABLE OF CONTENTS

| | Information About the Annual Meeting | Information About the Annual Meeting | | | Report of the Compensation Committee | | Information About the Annual Meeting | | | 2021 Performance Share Award Payout | |

| | Security Ownership of Certain Beneficial Owners and Management | Security Ownership of Certain Beneficial Owners and Management | | | Executive Compensation | |

| Security Ownership of Certain Beneficial Owners and Management | |

| Security Ownership of Certain Beneficial Owners and Management | | | | Stock Ownership Guidelines | |

| | Proposal 1—Election of Directors | |

| Proposal 1—Election of Directors | |

| Proposal 1—Election of Directors | Proposal 1—Election of Directors | | | Summary Compensation Table | | | | Retirement Benefits | |

| | Meetings and Committees of the Board of Directors | Meetings and Committees of the Board of Directors | | | Grants of Plan-Based Awards Table | |

| Meetings and Committees of the Board of Directors | |

| Meetings and Committees of the Board of Directors | | | | Perquisites and Other Benefits | |

| | Corporate Governance | Corporate Governance | | | Outstanding Equity Awards Table | |

| Corporate Governance | |

| Corporate Governance | | | | Regulatory Considerations | |

| | Corporate Responsibility | | | Option Exercises and Stock Vested | |

| Environmental, Social and Governance Practices | |

| Environmental, Social and Governance Practices | |

| Environmental, Social and Governance Practices | | | | Clawback Policy | |

| | Director Compensation | |

| Director Compensation | |

| Director Compensation | Director Compensation | | | Nonqualified Deferred Compensation | | | | Anti-Hedging and Pledging Policy | |

| | Proposal 2—Advisory (Non-Binding) Vote on Executive Compensation | Proposal 2—Advisory (Non-Binding) Vote on Executive Compensation | | | Potential Payments Upon Termination or Change in Control | |

| Proposal 2—Advisory (Non-Binding) Vote on Executive Compensation | |

| Proposal 2—Advisory (Non-Binding) Vote on Executive Compensation | | | | Tax and Accounting Considerations | |

| | Compensation Discussion and Analysis | Compensation Discussion and Analysis | | | Employment Agreements and Severance/Change in Control Benefits | |

| Compensation Discussion and Analysis | |

| Compensation Discussion and Analysis | | | | Report of the Compensation Committee | |

| | Executive Summary | | | Equity Plans | |

| | | Executive Compensation | |

| | | Executive Compensation | |

| | | Executive Compensation | | |

| | Company Summary | |

| Company Summary | |

| Company Summary | | | | Summary Compensation Table | |

| | 2023 Business Highlights | |

| 2023 Business Highlights | |

| 2023 Business Highlights | | | | Grants of Plan-Based Awards Table | |

| | 2023 Executive Compensation Highlights | |

| 2023 Executive Compensation Highlights | |

| 2023 Executive Compensation Highlights | | | | Outstanding Equity Awards Table | |

| | 2023 Say-on-Pay Results and Shareholder Outreach | |

| 2023 Say-on-Pay Results and Shareholder Outreach | |

| 2023 Say-on-Pay Results and Shareholder Outreach | | | | Option Exercises and Stock Vested | |

| | Best Practice Features | |

| Best Practice Features | |

| Best Practice Features | | | | Nonqualified Deferred Compensation | |

| | 2023 Key Performance Metrics | |

| 2023 Key Performance Metrics | |

| 2023 Key Performance Metrics | | | | Potential Payments Upon Termination or Change in Control | |

| | Philosophy and Objectives of Our Executive Compensation Program | |

| Philosophy and Objectives of Our Executive Compensation Program | |

| Philosophy and Objectives of Our Executive Compensation Program | Philosophy and Objectives of Our Executive Compensation Program | | | Split-Dollar Agreements | | | | Employment Agreements and Severance/Change in Control Benefits | |

| | Role of the Compensation Committee | Role of the Compensation Committee | | | Management Incentive Plan | |

| Role of the Compensation Committee | |

| Role of the Compensation Committee | | | | Equity Plans | |

| | Role of Management in Compensation Committee Deliberations | |

| Role of Management in Compensation Committee Deliberations | |

| Role of Management in Compensation Committee Deliberations | Role of Management in Compensation Committee Deliberations | | | Compensation Committee Interlocks and Insider Participation | | | | Split-Dollar Agreements | |

| | Compensation Consultants and Advisors | Compensation Consultants and Advisors | | | CEO Pay Ratio | |

| Compensation Consultants and Advisors | |

| Compensation Consultants and Advisors | | | | Management Incentive Plan | |

| | Use of Competitive Data | |

| Use of Competitive Data | |

| Use of Competitive Data | Use of Competitive Data | | | Report of the Audit and Finance Committee | | | | Compensation Committee Interlocks and Insider Participation | |

| | Performance-Based Equity Peer Group | Performance-Based Equity Peer Group | | | Proposal 3—Ratification of the Appointment of Independent Registered Public Accounting Firm | |

| Performance-Based Equity Peer Group | |

| Performance-Based Equity Peer Group | | | | CEO Pay Ratio | |

| | Components of Compensation | |

| Components of Compensation | |

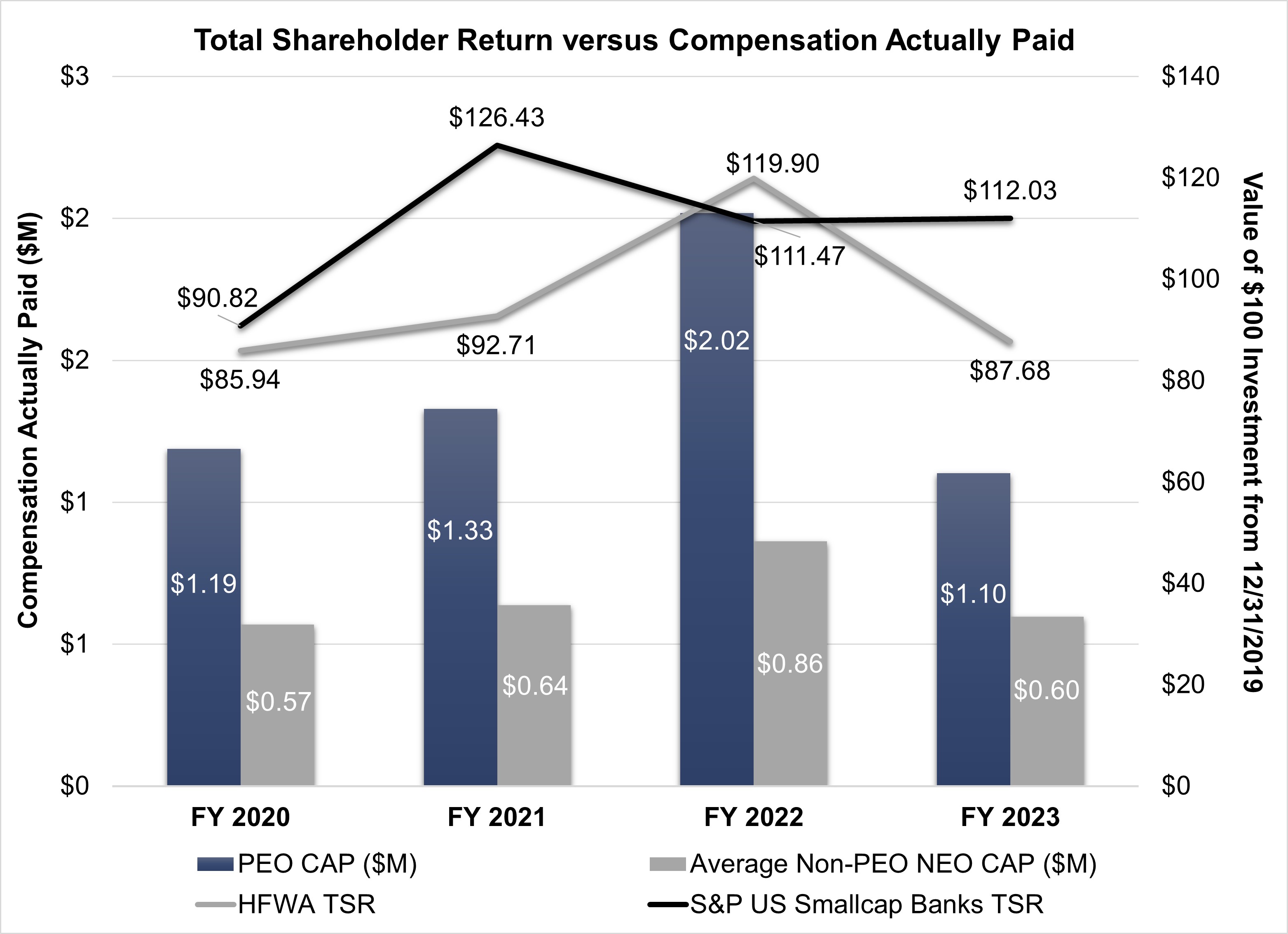

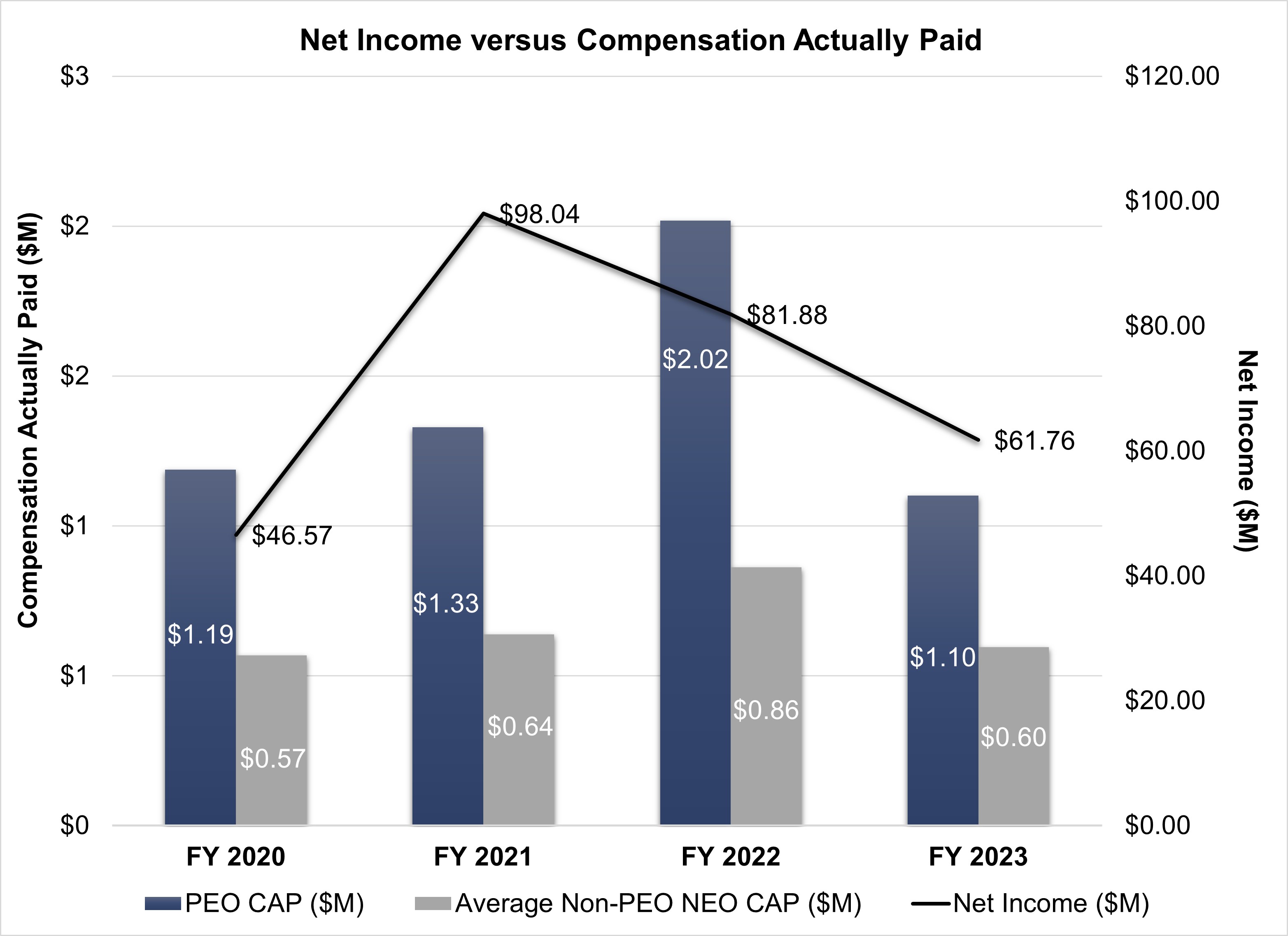

| Components of Compensation | | | | Pay Versus Performance | |

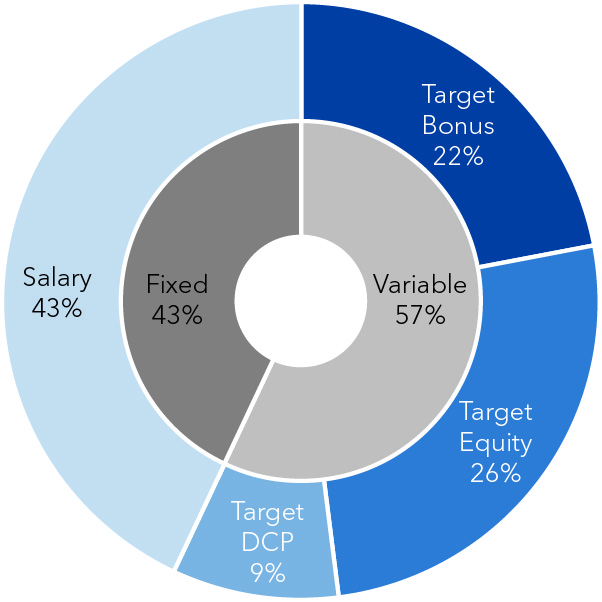

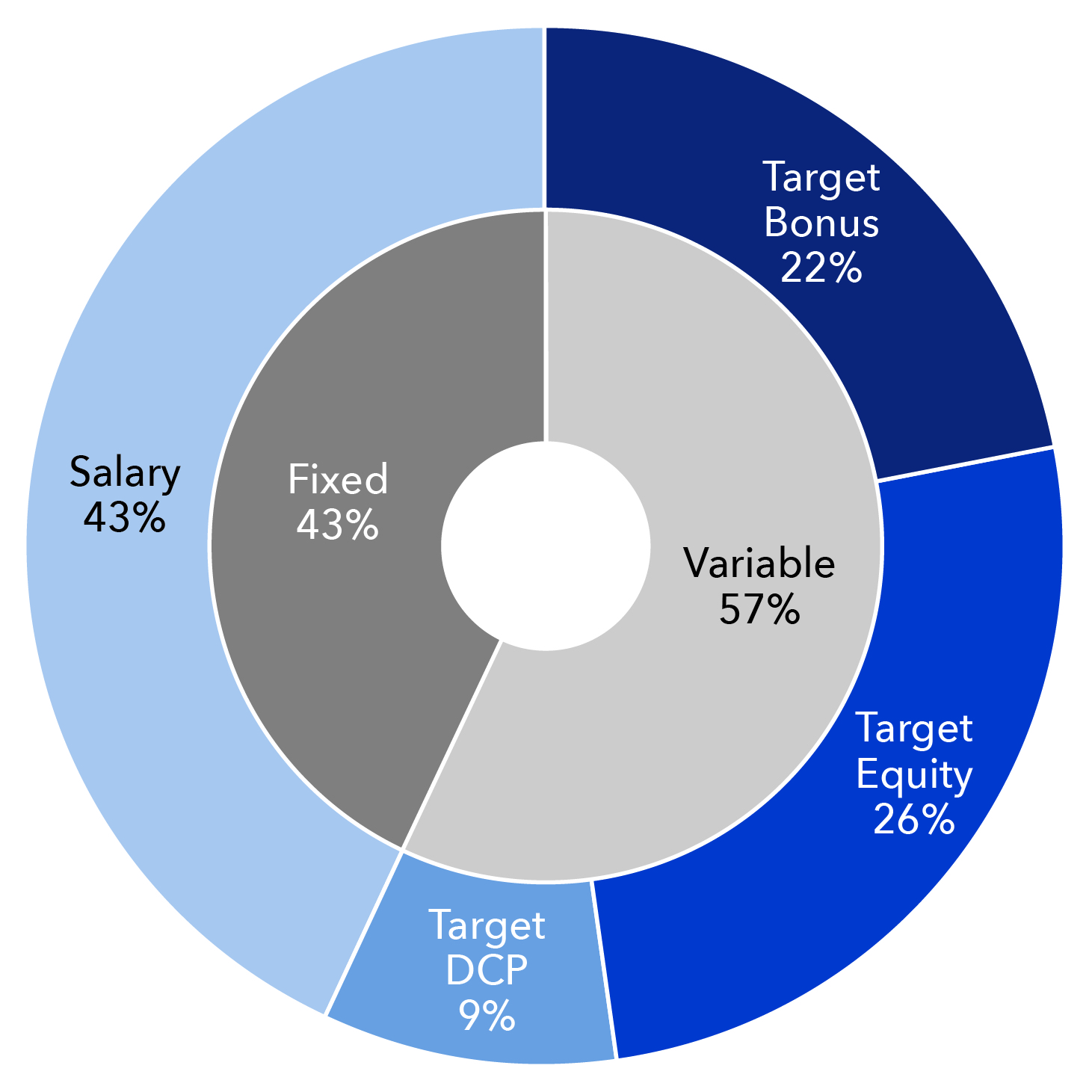

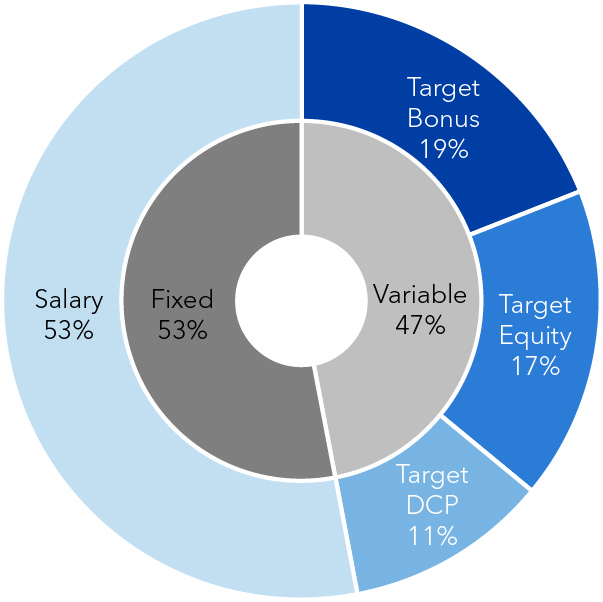

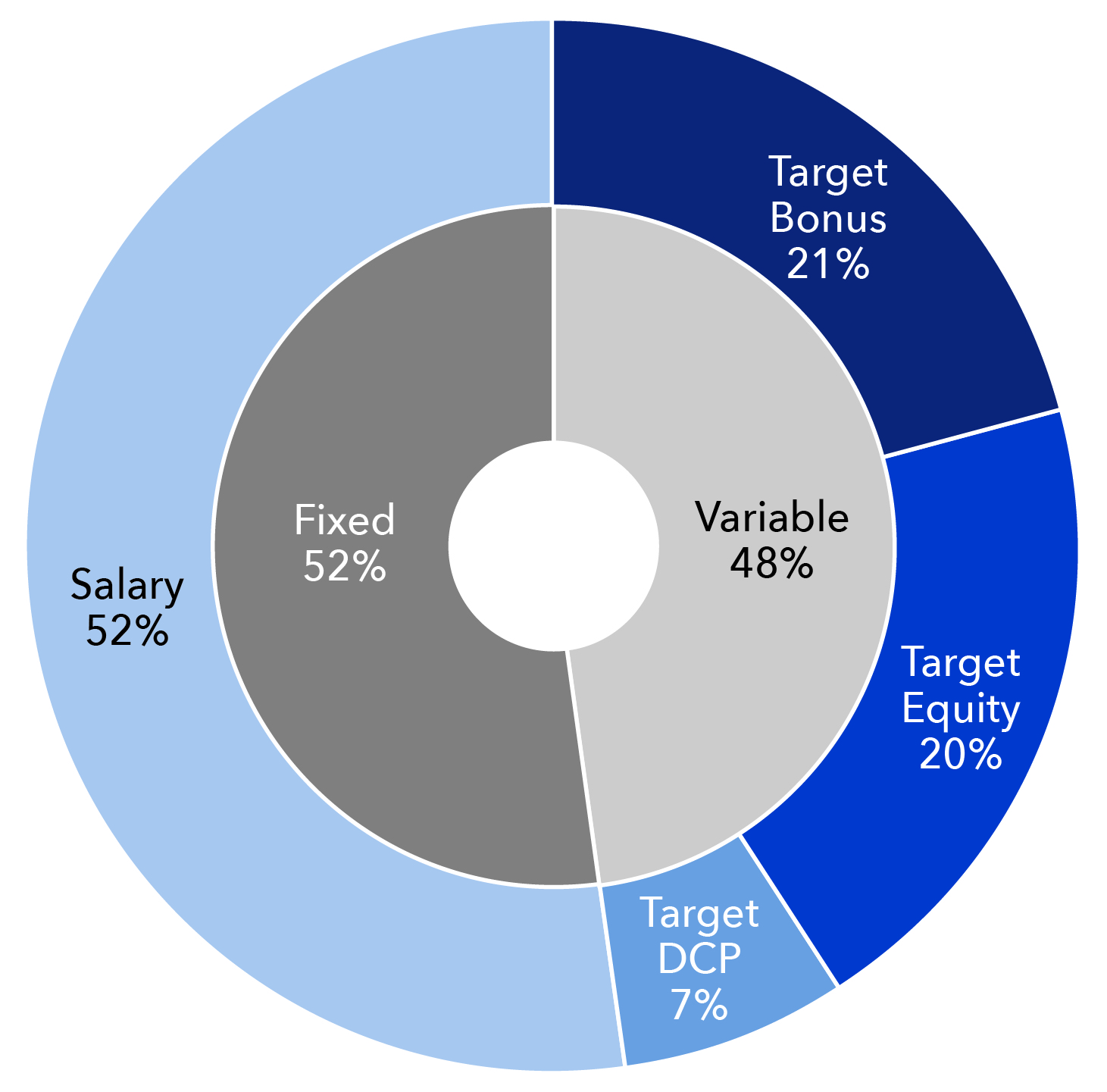

| | Target Pay Mix | |

| Target Pay Mix | |

| Target Pay Mix | Target Pay Mix | | | Shareholder Proposals | | | | Report of the Audit and Finance Committee | |

| | Base Salary | Base Salary | | | Miscellaneous | |

| Base Salary | |

| Base Salary | | | | Proposal 3—Ratification of the Appointment of Independent Registered Public Accounting Firm | |

| | Salary Adjustments Made in 2020 | | |

| Salary Adjustments Made in 2023 | |

| Salary Adjustments Made in 2023 | |

| Salary Adjustments Made in 2023 | | | | Shareholder Proposals | |

| | Annual Cash Incentives | |

| Annual Cash Incentives | |

| Annual Cash Incentives | Annual Cash Incentives | | | | | Miscellaneous | |

| | Annual Cash Incentive Performance Goals | Annual Cash Incentive Performance Goals | | |

| Annual Cash Incentive Performance Goals | |

| Annual Cash Incentive Performance Goals | |

| | 2020 Annual Cash Incentive Award Determinations | | |

| 2023 Annual Cash Incentive Award Determinations | |

| | 2023 Annual Cash Incentive Award Determinations | |

| | 2023 Annual Cash Incentive Award Determinations | |

| | Equity-Based Compensation | Equity-Based Compensation | | |

| | 2020 Equity Award Determinations | | |

| Equity-Based Compensation | |

| | Stock Ownership Guidelines | | |

| Equity-Based Compensation | |

| | Retirement Benefits | | |

| 2023 Equity Award Determinations | |

| | Perquisites and Other Benefits | | |

| 2023 Equity Award Determinations | |

| | Regulatory Considerations | | |

| | Clawback Policy | | |

| | Tax and Accounting Considerations | | |

| 2023 Equity Award Determinations | |

PROXY STATEMENT

20212024 ANNUAL MEETING OF SHAREHOLDERS

HERITAGE FINANCIAL CORPORATION

201 Fifth Avenue S.W.

Olympia, Washington 98501

(360) 943-1500

The Board of Directors of Heritage Financial Corporation (“Board”) is using this Proxy Statement to solicit proxies from our shareholders for use at the annual meeting of shareholders. We first provided access to this Proxy Statement and a form of proxy card on March 19, 2021.22, 2024.

The information provided in this Proxy Statement relates to Heritage Financial Corporation and its wholly-owned bank subsidiary, Heritage Bank. Heritage Financial Corporation may also be referred to as “Heritage” or the “Company.” All references in this Proxy Statement to “Heritage,” “we,” “us” and “our” or similar references mean Heritage Financial Corporation and its consolidated subsidiaries.

Information About the Annual Meeting

Our annual meeting will be held as follows:

| | | | | | | | |

| Date: | | | | | | | | May 6, 2024 |

| | Date: | May 4, 2021

| Time: | | |

| Time: | 9:00 a.m., Pacific Time |

| | |

| Place: | Place: | Virtual Meeting |

| | www.meetingcenter.io/241594936 |

| | Meeting password is HFWA2021 - www.meetnow.global/MGGV9A7 |

Matters to Be Considered at the Annual Meeting

At the meeting, you will be asked to consider and vote on:

•The election of eleventen directors to each serve for a one-year term.

•An advisory non-binding,(non-binding) resolution to approve the compensation paid to our named executive officers, as disclosed in this Proxy Statement.officers.

•The ratification of the Audit and Finance Committee’s appointment of Crowe LLP as our independent registered public accounting firm for the year ending December 31, 2021.2024.

We will also transact any other business that may properly come before the annual meeting. As of the date of this Proxy Statement, we are not aware of any business to be presented for consideration at the annual meeting other than the matters described in this Proxy Statement.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to Be Held on May 4, 20216, 2024

Our Proxy Statement, the Notice of Internet Availability of Proxy Materials and our Annual Report to Shareholdersproxy materials are available at www.hf-wa.com. The following materials are available for review:

•Proxy Statement;

•Notice of Internet Availability of Proxy Materials;

•Proxy Card; and

•Annual Report to Shareholders.

We provided access to our proxy materials beginning on March 19, 2021.22, 2024. On that day, we mailed the Notice of Availability of Proxy Materials to our shareholders. The Securities and Exchange Commission ("SEC") allows us to deliver proxy materials to shareholders over the Internet. We believe that this offers a convenient way for shareholders to review our information. It also reduces printing expenses and lessens the environmental impact of mailing paper copies of the annual meeting materials.

Who is Entitled to Vote?

We have fixed the close of business on March 8, 2021,11, 2024 as the record date for shareholders entitled to notice of and to vote at our annual meeting. Only holders of record of Heritage’s common stock on that date are entitled to notice of and to vote at the annual meeting. You are entitled to one vote for each share of Heritage common stock you own, unless you acquired more than 10% of Heritage’s outstanding common stock without prior Board approval. As provided in our Articles of Incorporation, for each vote in excess of 10% of the voting power of the outstanding shares of Heritage’s voting stock, the record holders in the aggregate will be entitled to cast one-hundredth of a vote, and the aggregate power of these record holders will be allocated proportionately among these record holders. On March 8, 2021,11, 2024, there were 35,914,77534,655,226 shares of Heritage common stock outstanding and entitled to vote at the annual meeting.

How Do I Vote at the Annual Meeting?

Proxies are solicited to provide all shareholders on the voting record date an opportunity to vote on matters scheduled for the annual meeting and described in these materials. This answer provides voting instructions for shareholders of record. You are a shareholder of record if your shares of Heritage common stock are held in your name. If you are a beneficial owner of Heritage common stock held by a broker, bank or other nominee (i.e., in “street name”), please see the instructions below, under "What if My Shares Are Held in "Street Name" by a Broker?"

Shares of Heritage common stock can only be voted if the shareholder is present virtually or by proxy at the annual meeting. To ensure your representation at the annual meeting, we recommend you vote by proxy even if you plan to attend the virtual annual meeting. You can always change your vote at the meeting if you are a shareholder of record and have joined the meeting as a "Shareholder." To join as a Shareholder, you will need the control number provided with the Notice Regarding the Availability of Proxy Materials or on your proxy card.Materials.

Voting instructions are included on the Notice of Internet Availability of Proxy Materials. Shares of Heritage common stock represented by properly executed proxies will be voted by the persons named on the form of proxy in accordance with the shareholder’s instructions. Where properly executed proxies are returned to us with no specific instruction as to how to vote at the annual meeting, the persons named in the proxy will vote the shares FOR the election of each of our director nominees, FOR advisory approval of the compensation of our named executive officers as disclosed in this Proxy Statement, and FOR the ratification of the appointment of Crowe LLP as our independent registered public accounting firm for the year ending December 31, 2021.2024. If any other matters are properly presented at the annual meeting for action, the persons named in the form of proxy and acting thereunder will have the discretion to vote on those matters in accordance with their best judgment. We do not currently expect that any other matters will be properly presented for action at the annual meeting.

You may receive more than one proxy depending on how your shares are held. For example, you may hold some of your shares individually, some jointly with your spouse and some in trust for your children. In this case, you will receive three separate proxies to vote.

What if My Shares Are Held in "Street Name" by a Broker?

If you are the beneficial owner of shares held in “street name” by a broker, bank or other nominee ("nominee"), the nominee, as the record holder of the shares, is required to vote the shares in accordance with your instructions. If you do not give instructions to the nominee, the nominee may nevertheless vote the shares with respect to discretionary items but will not be permitted to vote your shares with respect to non-discretionary items, pursuant to the rules governing brokers. In the case of non-discretionary items, the shares not voted will be treated as “broker non-votes.” The proposal for the election of directors and the advisory vote on executive compensation are

considered non-discretionary items; therefore, you must provide instructions to the nominee in order to have your shares voted on these proposals.

If your shares are held in street name, you must register in advance to fully participate in the annual meeting. You may participate as a "Guest" without having a unique control number, but you will not have the option to vote your shares or ask questions at the virtual meeting. To fully participate in the meeting as a "Shareholder," you must obtain a unique control number by registering in advance with Computershare and submitting proof of your proxy

power (legal proxy) reflecting your holdings along with your name and e-mail address to Computershare. Requests for registration must be labeled as “Legal Proxy” and be received no later than 5:00 p.m., Eastern Time, on April 20, 2021.22, 2024. You will receive a confirmation of your registration by email after we receive your registration materials.materials are received. Requests for registration should be made as follows:

forwardForward the email from your broker, or attach an image of your legal proxy, to legalproxy@computershare.com or send by mail to: Computershare, Heritage Financial Corporation Legal Proxy, P.O. Box 4300143006, Providence, RI 02940-3001.02940-3006.

How Will My Shares of Common Stock Held in the 401(k) Profit Sharing Plan Be Voted?

We maintain a 401(k) profit sharing plan (“401(k) Plan”), which owned 270,253234,723 shares or 0.75%0.68% of Heritage’s common stock as of the record date. Our employees participate in the 401(k) Plan. Each participant may instruct the 401(k) Plan trustee how to vote the shares of Heritage common stock allocated to his or herthe participant's account under the Plan by completing a vote authorization form. If a participant properly executes a vote authorization form, the 401(k) Plan trustee will vote the participant’s shares in accordance with the participant’s instructions. 401(k) Plan shares for which proper voting instructions are not received will not be voted. In order toTo give the trustee sufficient time to vote, all vote authorization forms, which are in the form of a proxy card, must be received from 401(k) Plan participants by the transfer agentComputershare by April 27, 2021.29, 2024.

How Many Shares Must Be Present to Hold the Meeting?

A quorum must be present at the meeting for any business to be conducted. The presence at the meeting, virtually or by proxy, of at least a majority of the shares of Heritage common stock entitled to vote at the annual meeting as of the record date will constitute a quorum. Proxies received but marked as abstentions or broker non-votes will be included in the calculation of the number of shares considered to be present at the meeting.

What if a Quorum is Not Present at the Meeting?

If a quorum is not present at the scheduled time of the meeting, a majority of the shareholders present virtually or represented by proxy may adjourn the meeting until a quorum is present. The time and place of the adjourned meeting will be announced at the time the adjournment is taken, and no other notice will be given unless a new record date for the meeting is set. An adjournment will have no effect on the business that may be conducted at the meeting.

Vote Required to Approve Proposal 1: Election of Directors

Our Bylaws provide for the election of directors by the majority of votes cast by shareholders in uncontested elections, and providewhich means that in an uncontested election, the number of shares voted "for" a director nominee must exceed the number of shares voted "against" asuch director nominee in order for athe director nominee to be elected. The following are not considered votes cast: (1) a share otherwise present at the meeting but for which there is an abstention; and (2) a share otherwise present at the meeting as to which a shareholder of record gives no authority or direction.direction (also known as a broker non-vote). The term of any director who was a director at the time of the election but who does not receive a majority ofsufficient votes cast in an election held under the new majority vote standard will continue to serve as a director until terminated on the earliest to occur of: (1) 90 days after the date election results are determined; (2) the date the Board appoints a new director to fill the position; or (3) the date and time the director's resignation is effective.

Our Bylaws provide that an election is considered a "contested election" if there are shareholder nominees for director pursuant to Heritage's advance notice provision and who are not withdrawn by the advance notice deadline set forth in Heritage's Articles of Incorporation.Incorporation, as amended. If the Board determines there is a "contested election," the election of directors will be held under a plurality standard. Under the plurality standard, the nominees who receive the highest number of votes for the directorships for which they have been nominated will be elected.

Pursuant to our Articles of Incorporation, shareholders are not permitted to cumulate their votes for the election of directors. Votes may be cast for or against each nominee, or shareholders may abstain from voting. Abstentions and

broker non-votes will have no effect on the outcome of the election.election because they are not considered votes cast. Our Board of Directors unanimously recommends that you vote FOR the election of each of its director nominees.

Vote Required to Approve Proposal 2: Advisory Vote on Executive Compensation

Approval of the advisory (non-binding) resolutionvote to approve the compensation paid to our named executive officers requires the affirmative vote of the majority of the shares of Heritage common stock present, in personvirtually or by proxy, and entitled to vote at the annual meeting. Abstentions are not affirmative votes and, therefore, will have the same effect as a vote against the proposal. Broker non-votes are not entitled to vote and therefore will have no effect on the approval of the proposal. Our Board of Directors unanimously recommends that you vote FOR the adoption of an advisory resolution to approve the compensation paid to our named executive officers as disclosed in this Proxy Statement.officers.

Vote Required to Approve Proposal 3: Ratification of the Appointment of Our Independent Registered Public Accounting Firm

Ratification of the Audit and Finance Committee’s appointment of Crowe LLP as our independent registered public accounting firm for the year ending December 31, 2021,2024, requires the affirmative vote of the majority of the shares of Heritage common stock present, in personvirtually or by proxy, and entitled to vote at the annual meeting by holders of Heritage common stock.meeting. Abstentions are not affirmative votes and, therefore, will have the same effect as a vote against the proposal. Our Board of Directors unanimously recommends that you vote FOR the ratification of the appointment of Crowe LLP as our independent registered public accounting firm for the year ending December 31, 2021.2024.

May I Revoke My Proxy?

You may revoke your proxy before it is voted by:

•submitting a new proxy with a later date;

•notifying the Corporate Secretary of Heritage in writing (or if you hold your shares in street name, your broker, bank or other nominee) before the annual meeting that you have revoked your proxy; or

•voting at the virtual annual meeting.

If you plan to attend the virtual annual meeting and wish to vote during the meeting, you must join the meeting as a "Shareholder." If you are a shareholder orof record, you will need the control number provided with the Notice Regarding the Availability of Proxy Materials or on your proxy card.Materials. If you are the beneficial owner of shares held in "street name" by a broker, bank or other nominee, you will need to register in advance with Computershare by following the instructions in the section titled "What if My Shares Are Held in Street Name"Street Name" by a Broker?"

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following tables set forth, as of the record date or the most currently reported date, information regarding share ownership of:

•those persons or entities (or groups of affiliated persons or entities) known by management to beneficially own more than five percent of Heritage’s common stock other than directors and executive officers;

•each director of Heritage;

•each executive officer of Heritage named in the Summary Compensation Table appearing under “Executive Compensation” below (known as “named executive officers”); and

•all current directors and executive officers of Heritage as a group.

On March 8, 2021,11, 2024, there were 35,914,77534,655,226 shares of Heritage common stock outstanding.

Persons and groups who beneficially own in excess of five percent of Heritage’s common stock are required to file with the SEC, and provide a copy to Heritage, reports disclosing their ownership pursuant to the Securities Exchange Act of 1934, as amended (“Securities Exchange Act”). To our knowledge, no other person or entity, other than as set forth below, beneficially owned more than five percent of the outstanding shares of Heritage’s common stock.

| | Beneficial Owners of More than 5% | Beneficial Owners of More than 5% | Number of Shares Beneficially Owned | Percent of Common Stock Outstanding | Beneficial Owners of More than 5% | Number of Shares Beneficially Owned | Percent of Common Stock Outstanding |

BlackRock Inc. (1) 55 East 52nd Street New York, NY 10055 | BlackRock Inc. (1) 55 East 52nd Street New York, NY 10055 | 5,272,197 | 14.7% | BlackRock Inc. (1) 55 East 52nd Street New York, NY 10055 | 5,072,306 | 14.5% |

T. Rowe Price Associates, Inc. (2) 100 E. Pratt Street Baltimore, MD 21202 | 3,577,059 | 9.9% |

The Vanguard Group (3) 100 Vanguard Boulevard Malvern, PA 19355 | 2,353,706 | 6.6% |

The Vanguard Group (2) 100 Vanguard Boulevard Malvern, PA 19355 | | The Vanguard Group (2) 100 Vanguard Boulevard Malvern, PA 19355 | 2,675,478 | 7.7% |

AllianceBernstein L.P. (3) 501 Commerce Street Nashville, TN 37203 | | AllianceBernstein L.P. (3) 501 Commerce Street Nashville, TN 37203 | 1,991,278 | 5.7% |

Dimensional Fund Advisors LP (4) 6300 Bee Cave Road, Building One Austin, TX 78746 | | Dimensional Fund Advisors LP (4) 6300 Bee Cave Road, Building One Austin, TX 78746 | 1,733,722 | 5.0% |

(1)According to a Schedule 13G13G/A filed with the SEC on January 26, 202123, 2024 reporting shares owned as of December 31, 2020,29, 2023, BlackRock Inc. hashad sole voting power over 5,205,0634,995,852 shares and sole dispositive power over 5,272,1975,072,306 shares. The interest of BlackRock FundiShares Core S&P Small-Cap ETF Advisors in the common stock of Heritage is more than 5% of the total outstanding common stock.

(2)According to a Schedule 13G filed with the SEC on February 16, 202113, 2024 reporting shares owned as of December 31, 2020, T. Rowe Price Associates, Inc. Inc. has sole29, 2023, the Vanguard Group had shared voting power over 968,94432,363 shares, and sole dispositive power over 3,577,0592,612,144 shares, and shared dispositive power over 55,269 shares.

(3)According to a Schedule 13G filed with the SEC on February 10, 202114, 2024 reporting shares owned as of December 31, 2020, the Vanguard Group has29, 2023, AllianceBernstein L.P. had sole voting power over zero1,811,861 shares shared voting power over 37,791 shares,and sole dispositive power over 2,285,8701,991,278 shares.

(4)According to a Schedule 13G filed with the SEC on February 9, 2024 reporting shares owned as of December 29, 2023, Dimensional Fund Advisors LP had sole voting power over 1,694,167 shares, and shared dispositive power over 67,8361,733,722 shares.

Beneficial ownership is determined in accordance with the rules and regulations of the SEC. In accordance with Rule 13d-3 of the Securities Exchange Act, a person is deemed to be the beneficial owner of any shares of common stock if he or she has voting and/or investment power with respect to those shares. Therefore, the table below includes shares owned by spouses, other immediate family members in trust, shares held in retirement accounts or funds for the benefit of our named individuals, and other forms of ownership, over which shares the persons named in the table may possess voting and/or investment power. In addition, in computing the number of shares beneficially owned by a person and the percentage ownership of that person, shares of common stock subject to outstanding options that are currently exercisable or exercisable within 60 days after March 8, 2021 and restricted stock units that will vest within 60 days after March 8, 202111, 2024, the record date, are included in the number of shares beneficially owned by the person and are deemed outstanding for the purpose of calculating the person’s percentage ownership. These shares, however, are not deemed outstanding for the purpose of computing the percentage ownership of any other person.

The following table shows, as of March 8, 2021,11, 2024, the amount of Heritage common stock owned (unless otherwise indicated) by each director and named executive officer, and all of our directors and executive officers as a group.

| | Directors & Named Executive Officers | Directors & Named Executive Officers | Shares | | Restricted Stock Units (1) | Total

Beneficial Ownership | Percent of Common Stock Outstanding | Directors & Named Executive Officers | Shares | | Restricted Stock Units (1) | Total

Beneficial Ownership | Percent of Common Stock Outstanding |

| Brian S. Charneski | Brian S. Charneski | 44,028 | (2) | 1,991 | 46,019 | * | Brian S. Charneski | 50,215 | (2) | 3,023 | 53,238 | * |

| John A. Clees | 50,018 | (3) | 1,991 | 52,009 | * |

| Stephen A. Dennis | 32,113 | (4) | 1,991 | 34,104 | * |

| Jeffrey J. Deuel | Jeffrey J. Deuel | 39,351 | | 6,315 | 45,666 | * | Jeffrey J. Deuel | 59,933 | (3) | 13,664 | 73,597 | * |

| Trevor D. Dryer | | Trevor D. Dryer | 1,808 | | 3,023 | 4,831 | * |

| Kimberly T. Ellwanger | Kimberly T. Ellwanger | 21,653 | | 1,991 | 23,644 | * | Kimberly T. Ellwanger | 26,868 | (4) | 3,023 | 29,891 | * |

| Deborah J. Gavin | Deborah J. Gavin | 12,534 | | 1,991 | 14,525 | * | Deborah J. Gavin | 18,046 | | 3,023 | 21,069 | * |

| Gail B. Giacobbe | | Gail B. Giacobbe | 1,808 | | 3,023 | 4,831 | * |

| Jeffrey S. Lyon | Jeffrey S. Lyon | 41,373 | (5) | 1,991 | 43,364 | * | Jeffrey S. Lyon | 42,550 | | 3,023 | 45,573 | * |

| Gragg E. Miller | 27,310 | (6) | 1,991 | 29,301 | * |

| Anthony B. Pickering | 55,573 | (7) | 1,991 | 57,564 | * |

| Frederick B. Rivera | Frederick B. Rivera | — | | — | Frederick B. Rivera | 4,821 | | 3,023 | 7,844 | * |

| Ann Watson | Ann Watson | 12,440 | (8) | 1,991 | 14,431 | * | Ann Watson | 17,952 | (5) | 3,023 | 20,975 | * |

| Brian L. Vance | Brian L. Vance | 126,292 | (9) | 10,219 | 136,511 | * | Brian L. Vance | 118,882 | (6) | 3,023 | 121,905 | * |

| Tony W. Chalfant | Tony W. Chalfant | 17,750 | (4) | 1,280 | 19,030 | * | Tony W. Chalfant | 19,775 | (7) | 3,518 | 23,293 | * |

| Donald J. Hinson | Donald J. Hinson | 32,233 | | 3,031 | 35,264 | * | Donald J. Hinson | 39,249 | | 4,151 | 43,400 | * |

| Cindy M. Huntley | 21,644 | (10) | 2,276 | 23,920 | * |

| Bryan D. McDonald | Bryan D. McDonald | 23,953 | (11) | 3,617 | 27,570 | * | Bryan D. McDonald | 34,419 | (8) | 5,505 | 39,924 | * |

Directors and Executive Officers as a group

(20 persons) | 586,832 | | 49,821 | 636,653 | 1.8% |

| Matthew T. Ray | | Matthew T. Ray | 13,926 | | 3,360 | 17,286 | * |

Directors and Executive Officers as a group

(19 persons) | | Directors and Executive Officers as a group

(19 persons) | 511,323 | | 72,299 | 583,622 | 1.68% |

| | | | | |

| * | Less than one percent of shares outstanding |

(1)Represents time-basedservice-based restricted stock and performance stock units (at target) which will vest within 60 days of March 8, 2021.11, 2024.

(2)Includes 14,00013,675 shares owned by an entity controlled by Mr. Charneski.

(3)Includes 46,468 shares held jointly with his spouse, 1,050 shares owned solely by his spouse and 2,500 shares owned by an entity controlled by Mr. Clees.

(4)Shares are held jointly with his spouse.

(5)Includes 3,235 shares held as custodian for a minor and 2,850 shares held by his daughter.

(6)Includes 22,665 shares held jointly with his spouse and 4,645 shares held in a simplified employee pension plan.

(7)Includes 47,449 shares held jointly with his spouse, 4,0625,391 shares held in Mr. Pickering's IRA and 4,062 sharesDeuel's IRA.

(4)Shares are held in Mr. Pickering's spouse's IRA.trust.

(8)(5)Includes 4,000 shares held in Ms. Watson's IRA and 8,44013,952 shares held jointly with her spouse.

(9)(6)Includes 104,56494,173 shares held jointly with his spouse and 21,72824,709 vested shares in the 401(k) plan.

(10)Includes 2,339 shares held in the 401(k) plan.

(11)(7)Shares are held jointly with his spouse.

(8)Includes 12,37322,755 shares held jointly with his spouse and 10,25611,664 vested shares held in the 401(k) plan.

PROPOSAL 1—ELECTION OF DIRECTORS

Our Board of Directors currently consists of 1210 directors. The 1110 directors below have been nominated to serve a one-year term ending at the 20222025 annual meeting of shareholders, or when their respective successors have been duly elected and qualified. Director Stephen A. Dennis will retire effective as of the annual meeting.

The table below sets forth information regarding each director of Heritage standing for re-election,election, including his or her age, position and term of office. Each nominee currently serves as a director and has consented to being named in this Proxy Statement and has agreed to serve if elected. If a nominee is unable to stand for election, the Board of Directors may either reduce the number of directors to be elected or select a substitute nominee. If a substitute nominee is selected, the proxy holders will vote your shares for the substitute nominee, unless you have withheld authority. At this time, we are not aware of any reason why a nominee might be unable to serve if elected.

The Board of Directors recommends you vote FOR the election of each of the nominees in the table below.

| | | | | | | | | | | | | | |

| Name | Age(1) | Position(s) Held with

Heritage | Director Since | Term to

Expire(2) |

| Brian S. Charneski | 59 | Director | 2000 | 2022 |

| John A. Clees | 73 | Director | 2005 | 2022 |

| Jeffrey J. Deuel | 62 | Director, President & CEO | 2019 | 2022 |

| Kimberly T. Ellwanger | 61 | Director | 2006 | 2022 |

| Deborah J. Gavin | 64 | Director | 2013* | 2022 |

| Jeffrey S. Lyon | 68 | Director | 2001 | 2022 |

| Gragg E. Miller | 69 | Director | 2009* | 2022 |

| Anthony B. Pickering | 73 | Director | 1996* | 2022 |

| Frederick B. Rivera | 52 | Director | 2020 | 2022 |

| Brian L. Vance | 66 | Chairman of the Board | 2002 | 2022 |

| Ann Watson | 59 | Director | 2012 | 2022 |

* Reflects year appointed to the Washington Banking Company (“Washington Banking”) Board of Directors. Washington Banking merged with Heritage in May 2014.

| | | | | | | | | | | | | | |

| Name | Age(1) | Position(s) Held with

Heritage | Director Since | Term to

Expire(2) |

| Brian S. Charneski | 62 | Director | 2000 | 2025 |

| Jeffrey J. Deuel | 65 | Director, President & CEO | 2019 | 2025 |

| Trevor D. Dryer | 45 | Director | 2022 | 2025 |

| Kimberly T. Ellwanger | 64 | Director | 2006 | 2025 |

| Deborah J. Gavin | 67 | Director | 2013 | 2025 |

| Gail B. Giacobbe | 55 | Director | 2022 | 2025 |

| Jeffrey S. Lyon | 71 | Director | 2001 | 2025 |

| Frederick B. Rivera | 55 | Director | 2020 | 2025 |

| Brian L. Vance | 69 | Board Chair | 2002 | 2025 |

| Ann Watson | 62 | Director | 2012 | 2025 |

(1) As of December 31, 2020.2023.

(2) Assuming re-election.

Business Experience of Nominees for Re-electionReelection

The business experience of each nominee of Heritage for at least the past five years and the experience, qualifications, attributes, skills and areas of expertise of each director that led to the conclusion that the person should serve as a director of Heritage is set forth below. All nominees have held their present positions for at least five years unless otherwise indicated.

indicated and none of the nominees serve as a director of a public company board other than Heritage. | | | | | | | | |

| BRIAN S. CHARNESKI | AGE: 59 DIRECTOR SINCE 2000 |

| Biographical Information: Brian S. Charneski is the President of L&E Bottling Company, based in Olympia, Washington, and is Chairman of Pepsi Northwest Beverages, LLC, a regional beverage manufacturing joint venture with PepsiCo, Inc. that is headquartered in Tumwater, Washington. Mr. Charneski is a director of the American Beverage Association and is also a memberChairman of the Board of Directors of the Pepsi-Cola Bottlers Association, having also chaired the Association from 2005 to 2007. Through his involvement, Mr. Charneski has extensive experience in the consumer products industry from product development, sales and marketing to manufacturing and logistics. Mr. Charneski is a past director of the Washington Center for Performing Arts, the Community Foundation of the South Sound and is a Trustee of St. Martin’s University. Mr. Charneski is a 1985 graduate of Seattle University with a Bachelor of Arts in Economics. Mr. Charneski was appointed as Lead Independent Director effective as of July 1, 2019, after having served as our Chairman since 2016. |

Committees: • Audit and Finance (Chair) • Compensation Corporate Governance and Nominating | Qualifications: Mr. Charneski serves as Lead Independent Director and provides a depth of knowledge in corporate and regulatory matters as he is a strong advocate for the beverage industry. He brings significant financial, legal, economic, human capital management, and merger and acquisition expertise to the Board. |

| | | | | | | | |

JOHN A. CLEES | AGE: 73 DIRECTOR SINCE 2005 |

| Biographical Information:

John A. Clees is an attorney at Worth Law Group with a practice emphasis in estate and business succession planning for closely held companies and their owners. Formerly, Mr. Clees was a Managing Director for nine years with a national certified public accounting firm, RSM, after they acquired the Olympia, Washington firm founded by Mr. Clees. Mr. Clees is a graduate of the University of Washington with a Bachelor of Arts in Economics and a graduate of the University of Washington School of Law. Mr. Clees is licensed as an attorney and mediator in the State of Washington. Mr. Clees served on Heritage’s Board of Directors from 1990 until 2000 and served as a non-voting consultant to Heritage’s Board of Directors and Audit Committee from 2000 until June 2005, when he was reappointed to the Board. He serves as a Board Member on the Community Foundation of South Puget Sound.

|

Committees:

• Nominating and Governance

• Risk (Chair)

| Qualifications:

Mr. Clees provides important tax and accounting expertise to the Board. He also brings a legal perspective to the Board, with a solid understanding of corporate governance matters.

|

| | | | | | | | |

| JEFFREY J. DEUEL | AGE: 62 DIRECTOR SINCE 2019 |

| Biographical Information: Jeffrey J. Deuel is President and Chief Executive Officer ("CEO") of Heritage, positions he has held since July 1, 2019. Previously,Immediately prior to his appointment as President and CEO of Heritage, Mr. Deuel was the President and Chief Executive OfficerCEO of Heritage Bank and the President of Heritage (Julyfrom July 2018 to July 2019), President and Chief Operating Officer of2019, having started at Heritage Bank and Executive Vice President of Heritage (September 2012 to July 2018),in September 2010 as Executive Vice President and Chief Operating Officerserving in positions of Heritage Bank and Executive Vice President of Heritage (November 2010 to September 2012) and Executive Vice President of Heritage Bank (February 2010 to November 2010).increasing importance. Prior to joining Heritage, Mr. Deuel held the position of Executive Vice President Commercial Operations with JPMorgan Chase, formerly Washington Mutual. Prior to joining Washington Mutual, Mr. Deuel was based in Philadelphia where he worked for Bank United, First Union Bank, CoreStates Bank, and First Pennsylvania Bank. During his career, Mr. Deuel has held a variety of leadership positions in commercial banking, including lending, credit administration, portfolio management, retail, corporate strategies and support services. He is past chair of the Washington Banker's Association and currently serves on the board of the Washington Bankers Association, the Oregon Bankers Association and Pacific Coast Banking School andSchool. Mr. Deuel earned his Bachelor’s degree at Gettysburg College. |

Committees: • Risk and Technology

| Qualifications: Mr. Deuel bringsprovides significant executive leadership skills and banking experience along with aas well as strategic focus and vision forto the Company. |

| | | | | | | | |

| TREVOR D. DRYER | DIRECTOR SINCE 2022 |

| Biographical Information: Trevor D. Dryer is the Director, Co-Founder and CEO of Carbon Title, a software company that is helping decarbonize the real estate industry. He was previously the CEO and Director of Mirador from 2014 to 2018. Mirador was a company he co-founded to provide small businesses with the digital platform to access reasonably-priced loans from banks and credit unions. Mirador was acquired by CUNA Mutual in 2018, and he remained on as CEO through early 2020 to facilitate the integration. After leaving CUNA Mutual, Mr. Dryer joined Serent Capital, a software-focused private equity firm, as a senior vice president on its growth team. During his tenure, Mr. Dryer served on the firm’s investment committee and worked with a variety of portfolio companies on corporate strategy and implementing processes to scale sales, customer success and other functions. He also serves on the board of Qualtik, a venture-backed software company and previously was the Executive Chair of Zingo, a startup that was sold to Credit Sesame in 2021. Mr. Dryer is a former attorney at Munger, Tolles & Olson as well as a judicial clerk on the U.S. Court of Appeals for the Ninth Circuit. Mr. Dryer earned a Juris Doctor degree from Stanford Law School. He attained a Bachelor of Arts degree in History and Literature from Harvard University, magna cum laude. |

Committees: • Audit and Finance • Risk and Technology | Qualifications: Mr. Dryer brings significant technical and entrepreneurial expertise to the Board, which is complemented by his legal expertise and executive leadership skills. |

| | | | | | | | |

| KIMBERLY T. ELLWANGER | AGE: 61 DIRECTOR SINCE 2006 |

| Biographical Information: Kimberly T. Ellwanger was Senior Director of Corporate Affairs and Associate General Counsel at Microsoft Corporation of Redmond, Washington from 1991 to 1999. She led Microsoft in developing a corporate presence in government, industry and community affairs including opening a Washington, D.C. office and developing a network of state and local government affairs representation. Prior to joining Microsoft, Ms. Ellwanger was a Partner at Perkins Coie in Seattle, Washington, where her legal practice included state and local tax planning, tax litigation, bankruptcy, general business and corporate advice and transactions. She has been involved in numerous civic and professional activities including serving on the Boards of the Northwest Chapter of the National Association of Corporate Directors (“NACD”), past Chair of the Community Foundation of South Puget Sound, the Providence St. Peter Foundation, the South Sound YMCA, past Chair of the Washington Council on International Trade and past Vice President of the Business Software Alliance. Ms. Ellwanger graduated with high honors from the University of Washington School of Law and graduated Phi Beta Kappa from Vassar College with an honors degree in economics. She has completed NACD's comprehensive program of study to become an NACD Leadership Fellow. |

Committees: • Compensation • Corporate Governance and Nominating and Governance (Chair) | Qualifications: Ms. Ellwanger brings significant legal expertise to the Board, which is complemented by her management and leadership skills and corporate, government and regulatory expertise. |

| | | | | | | | |

| DEBORAH J. GAVIN | AGE: 64 DIRECTOR SINCE 2013 |

| Biographical Information: Deborah J. Gavin was employed by the Boeing Company, an aerospace company, for over 20 years and retired from the position of Vice President of Finance and Controller in 2010. Prior to her employment with Boeing, Ms. Gavin held positions as a management consultant for Deloitte (a public accounting firm), and Special Agent with the U.S. Department of Treasury. She also taught undergraduate and graduate adjunct accounting courses at City University, Seattle, Washington. Ms. Gavin is a Certified Public Accountant in the State of Washington. She holds a Bachelor of Science degree in Business from the State University of New York College at Buffalo and a Master of Business Administration in Finance from Seattle University. Other board experiences include private company boards in Malaysia and China, and nonprofit organizations including the Washington Business Alliance and Snoqualmie Summit Central Ski Patrol. |

Committees: • Audit and Finance (Chair) • Risk and Technology | Qualifications: Ms. Gavin's extensive financial background, leadership skills, and depth of public company knowledge provide the Board with valuable expertise. Ms. Gavin is one of the Company'sHeritage's designated financial experts.expert. |

| | | | | | | | |

| GAIL B. GIACOBBE | DIRECTOR SINCE 2022 |

| Biographical Information: Gail B. Giacobbe serves as the Vice President, Product Management with Google. She is a senior technology products and services executive with extensive experience leading product organizations in enterprise, business-to-business, education and consumer software, spanning Fortune 100 companies, high growth venture capital and private equity funded enterprises. From 2019 to January 2024, she served as the Vice President, Product Management at Microsoft. From 2015 to 2019, Ms. Giacobbe served as the Vice President of Product and User Experience at GoDaddy, and led GoDaddy's Women in Tech employee resource group. Earlier in her career Ms. Giacobbe worked in a variety of product leadership roles at Microsoft, including Principal Group Product Manager for Skype, Outlook, and SharePoint. An active community leader, Ms. Giacobbe serves as a trustee for the Henry Art Gallery at the University of Washington where she sits on the governance committee. From 2011 to 2024, she served on the board of directors of JFS Seattle, where she was chair of the human resources and compensation committees. She graduated with honors from Princeton University and holds a Master of Arts in Teaching from Brown University. |

Committees: • Compensation • Risk and Technology | Qualifications: Ms. Giacobbe brings deep expertise in digital transformation, personalization, and customer experience to the Board. Ms. Giacobbe brings extensive experience in strategic leadership, management, and cultural transformation. |

| | | | | | | | |

| JEFFREY S. LYON | AGE: 68 DIRECTOR SINCE 2001 |

| Biographical Information: Jeffrey S. Lyon iscurrently serves as the Chairman Emeritus of Kidder Mathews, headquartered in Seattle, Washington. Mr. Lyon serves as a director forHe was formerly the Chairman of Kidder Mathews Inc. Mr. Lyon was Chairman andfrom 2000 to 2023. He retired as CEO for Kidder Mathews for over 20 years, stepping down as CEO on July 1, 2020.2020 and as Chairman on January 1, 2023. Mr. Lyon has over 4550 years of experience in the commercial real estate industry in the Puget Sound area. He iswas formerly a member of the Real Estate Advisory Board at the Runstad School of Real Estate at the University of Washington. Mr. Lyon earned a Bachelor of Arts degree in real estate and finance from the University of Oregon and is a certified member of the Commercial Investment Real Estate Institute (CCIM). He is an active community leader servingand currently serves on the boards of the CCIM Foundation and Evergreen Real Estate Operations companies, a private real estate company. He formerly served on the board of the Economic Development Council for Tacoma-Pierce County, and the CCIM Foundation.County. |

Committees: • Compensation (Chair) • Audit and Finance | Qualifications: Mr. Lyon provides expertise in the commercial real estate industry and has excellent entrepreneurial, strategic and executive leadership skills. |

| | | | | | | | |

GRAGG E. MILLER | AGE: 69 DIRECTOR SINCE 2009 |

| Biographical Information:

Gragg E. Miller served as the Principal Managing Broker of Coldwell Banker Bain realtors in Bellingham, Washington from 2011 to 2017. Prior to that, he was the Principal Managing Broker with Coldwell Banker since 1978. Mr. Miller earned his Bachelor of Arts degree from the University of Washington in 1973. He holds the GRI and CRB designations from the National Association of Realtors and was honored with the Lifetime Achievement Award from the Whatcom County Board of Realtors in 2006. He has held numerous board positions with the Washington Association of Realtors as well as the Whatcom County Board of Realtors. Mr. Miller's real estate investment experience includes ownership in Meridian Associates, LLC, Garden Street Associates, LLC and Cornwall Center, Inc.

|

Committees:

• Audit and Finance

• Risk

| Qualifications:

Mr. Miller provides expertise in the real estate industry and has extensive involvement in civic and business organizations in Bellingham, Washington.

|

| | | | | | | | |

ANTHONY B. PICKERING | AGE: 73 DIRECTOR SINCE 1996 |

| Biographical Information:

Anthony B. Pickering served as Chairman of the Board of Heritage following the merger between Heritage and Washington Banking from May 1, 2014 until May 1, 2016, and served as the Chairman of the Board of Washington Banking and its subsidiary Whidbey Island Bank from 2005 to 2014. Mr. Pickering owned Max Dale’s Restaurant and Stanwood Grill from 1983 and 2001, respectively, until 2008. He holds a Bachelor’s Degree in Mathematics from Washington State University. He is a past President of the Skagit Valley Hospital Foundation and previously served as a trustee for the Washington State University Foundation Board of Trustees and on the Board of the Economic Development Association of Skagit County. Mr. Pickering serves on the Board of Directors of the Skagit Regional Public Facilities District.

|

Committees:

• Audit and Finance

• Nominating and Governance

| Qualifications:

Mr. Pickering brings to the Board a business background with financial, human resources management and community relations experience.

|

| | | | | | | | |

| FREDERICK B. RIVERA | AGE: 53 DIRECTOR SINCE 2020 |

| Biographical Information: Frederick (Fred) B. Rivera is the Executive Vice President, Corporate Secretary, and General Counsel for the Seattle Mariners in Seattle, Washington. Previously, Mr. Rivera is an active community leaderwas a Partner at Perkins Coie law firm in Seattle from 1998 to 2017 and the Managing Partner from 2013 to 2017 with the exception of when he served as Vice President of Internal Investigations at Fannie Mae from 2006 to 2008. He began his legal career in 1993 as a trial attorney in the Civil Rights Division of the U.S. Department of Justice. Mr. Rivera currently serves on numerous boards includingof Delta Dental of Washington and OAC Services, Inc., and previously served on the board of NW Sports, LLC (ROOT Sports Network), OAC Services, Inc.,. An active community leader, Mr. Rivera has served on the boards of several non-profit organizations, including the United Way of King County Bar(Board Chair, 2019-2020), Rainier Scholars, the Seattle Colleges Foundation, the Downtown Seattle Association, the Association of Washington Businesses, and the Washington State Leadership Board, and the United Way of King County board, where he is the Immediate Past Board Chair.Board. He holds a Bachelor of Arts from California State University, Northridge and graduated from the Gonzaga School of Law. Mr. Rivera also completed the Executive Leadership Program at the Northwestern Kellogg School of Management. |

Committees: • Compensation • Risk Corporate Governance and Nominating | Qualifications: Mr. Rivera brings valuable legal expertise and management skills to the Board. He alsoMr. Rivera brings knowledge of the financial services industry, which includes credit administration, management and strategic forecasting. |

| | | | | | | | |

| BRIAN L. VANCE | AGE: 66 DIRECTOR SINCE 2002 |

| Biographical Information: Brian L. Vance has served as the Chairman of the Board Chair since May 2020, having served as the Executive Chair from July 2019 until May 2020. Mr. Vance was President and Chief Executive OfficerCEO of Heritage and Chief Executive OfficerCEO of Heritage Bank from 2006 and 2003, respectively, until July 2019. He served as President and Chief Executive OfficerCEO of Heritage Bank from 2003 until September 2012, when Jeffrey J. Deuel was promoted to President. Mr. Vance served as President and Chief Operating Officer of Heritage Bank from 1998 until 2003. Mr. Vance joined Heritage Bank in 1996 as its Executive Vice President and Chief Credit Officer. Prior to joining Heritage Bank, Mr. Vance was employed for 24 years with West One Bank, a bank with offices in Idaho, Utah, Oregon and Washington. Prior to leaving West One, he was Senior Vice President and Regional Manager of Banking Operations for the south Puget Sound region. Mr. Vance previously served as a director of the Pacific Bankers Management Institute, the Community Foundation of South Puget Sound, and the Western Independent Bankers Advisory Committee. He wasis the past President of the Washington Financial League and formerly served as a trustee for the South Puget Sound Community College. |

Committees: • Risk and Technology (Chair) | Qualifications: Mr. Vance brings valuable management and financial skills to the Board and provides extensive financial services industry knowledge, which includes credit administration, management and strategic forecasting. |

| | | | | | | | |

| ANN WATSON | AGE: 59 DIRECTOR SINCE 2012 |

| Biographical Information: Ann Watson has served since 2015 aswas the Chief Operating Officer of Cascadia Capital LLC, an investment banking firm headquartered in Seattle, Washington.Washington from 2015 to 2022. Ms. Watson previously served for two years as the Chief Financial Officer of Moss Adams LLP, a regional public accounting firm. She has also served as Chief Human Resources Officer, Management Committee Member, including the Information Technology Steering Committee and Risk Management Committee, Russell Mellon Board Member overseeing the Russell Indexes and as a Director in the Corporate Finance Group at Russell Investments, spanning a 15-year period. Prior to joining Russell Investments, she spent seven years with Chemical Bank/Manufacturers Hanover in New York and abroad where she held multiple global roles including strategic planning, loan workouts, client relationship management and credit analysis. Ms. Watson is a graduate of Columbia University with a Master of Business Administration and a graduate of Whitman College with a Bachelor of Arts in Economics. She serves on the Whitman College Board of Trustees. Among her prior community roles, she served as the Board Chair and Trustee of the Seattle Foundation, on the Board of the Washington Economic Development Finance Authority and on the Executive Committee of the Washington State China Relations Council. |

Committees: • Compensation (Chair) • Nominating Corporate Governance and GovernanceNominating | Qualifications: Ms. Watson brings extensive financial services industry and corporate financial knowledgeexpertise to the Board, including merger and acquisition experience. HerMs. Watson's significant executive leadership, compensation and human resources experience, and risk management background add to the Board's perspective. |

Board Composition

In making recommendations for nominees to the Board, the NominatingCorporate Governance and GovernanceNominating Committee actively considers the qualifications, strengths and abilities of the potential candidatecandidates for nomination. The Nominating and Governance Committee proactively manages board performance with annual board assessments and periodic peer assessments. Qualified director nominees are expected to have a mix of business experience, financial literacy, industry knowledge, technical expertise and integrity, be consensus buildersthe ability to work effectively in a group, and provide strategic oversight. During 2020, the Nominating and Governance Committee performed a director search and considered the above qualifications, while also focusing on diversity. The current composition of our Board reflects those efforts and the importance of diversity to the Board. The Board includes threefour women all of whom chair a committee, and one ethnically diverse director, as well as diverse skills and experience represented among all the director nominees. Additionally, the Board has an effective mix of experience and fresh perspective as illustrated below.

Board Performance and Evaluations

The Corporate Governance and Nominating Committee proactively manages the Board evaluation process. The Board's performance is reviewed through a rigorous annual Board self-evaluation process as well as biennial peer assessments. A third-party compiles anonymous reviews and reports back to the Corporate Governance and Nominating Chair. The Corporate Governance and Nominating Committee reviews the collective board evaluation results and develops an action plan for discussion and approval by the Board. The peer assessment results are shared with the Corporate Governance and Nominating Chair, the Board Chair, and the Lead Independent Director and communicated individually with each director.

Summary of Director Nominee Qualifications

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Area of Expertise | Charneski | Deuel | Dryer | Ellwanger | Gavin | Giacobbe | Lyon | Rivera | Vance | Watson |

| C-Suite Leadership | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Regulated Industry | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Financial Literacy | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Sales and Marketing | ✓ | ✓ | ✓ | | | ✓ | ✓ | ✓ | ✓ | ✓ |

| Strategic Planning | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Technology | | | ✓ | | | ✓ | | | | |

| Human Capital Management | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Enterprise Risk Management | ✓ | ✓ | ✓ | | ✓ | ✓ | | | ✓ | ✓ |

| Mergers and Acquisitions | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

Areas of Expertise

The table below outlines the relationship between the areas of expertise outlined in the director qualifications above.

| | | | | |

| Area of Expertise | Business Rationale for Expertise |

| C-Suite Leadership | Ensures that directors have experience executing strategy while understanding a multitude of competing priorities. |

| Regulated Industry | Integral to understanding the special issues facing companies in highly regulated industries. |

| Financial Literacy | Provides strong oversight of the Company's financial performance and reporting and related internal controls. |

| Sales and Marketing | Expertise in sales and marketing of products and branding. |

| Strategic Planning | Critical to drive the strategic direction and growth of the Company. |

| Technology | Relevant to the Company as it looks for ways to enhance the customer experience and internal operations and oversee cybersecurity risk. |

| Human Capital Management | Expertise in compensating, attracting and retaining top talent, creating talent development programs and succession planning is integral to the Company's long-term success. This skill also ensures compensation and benefits discourage imprudent risk taking and are aligned with stockholder interests. |

| Enterprise Risk Management | Integral to overseeing the Company's ERM framework and understanding the risks facing the Company. |

| Mergers and Acquisitions | Integral to the Company's ability to provide mergers and acquisitions oversight. |

Summary of Director Nominee Qualifications and ExperienceBoard Diversity

The following information reflects the Board composition as of the record date of this Proxy Statement:

| | | | | | | | |

| Board Size: | | |

| Total Number of Directors | 10 |

| Gender: | Female | Male |

| Number of Directors Based on Gender Identity | 4 | 6 |

| Number of Directors Who Identify in Any of the Categories Below: |

| Hispanic | — | 1 |

| White | 4 | 5 |

| | | | | | | | |

| Age Diversity | | | | | | | | | | | | | | | | | | | | Gender, Racial, and Ethnic Diversity |

| Name | Business

Expertise | Banking

ExperienceCPA, MBA or

Financial

Expertise | Attorney | Marketing/

Sales | Community

Presence |

Brian S. Charneski | ✓ | ✓ | ✓ | | ✓ | ✓ |

John A. Clees | ✓ | ✓ | ✓ | ✓ | | ✓ |

Jeffrey J. Deuel | ✓ | ✓ | ✓ | | ✓ | ✓ |

Kimberly T. Ellwanger | ✓ | ✓ | ✓ | ✓ | | ✓ |

Deborah J. Gavin | ✓ | ✓ | ✓ | | | ✓ |

Jeffrey S. Lyon | ✓ | ✓ | ✓ | | ✓ | ✓ |

Gragg E. Miller | ✓ | ✓ | | | ✓ | ✓ |

Anthony B. Pickering | ✓ | ✓ | | | ✓ | ✓ |

Frederick B. Rivera | ✓ | ✓ | | ✓ | | ✓ |

Brian L. Vance | ✓ | ✓ | ✓ | | ✓ | ✓ |

Ann Watson | ✓ | ✓ | ✓ | | | ✓ |

| | | | | | | | |

| Board Tenure | | | | | Board Independence |

| Board Tenure | Board Independence |

| | |

MEETINGS AND COMMITTEES

OF THE BOARD OF DIRECTORS

Board of Directors

The Board conducts its business through meetings of the Board and through its committees. The Board typically meets ten times per year, holding special meetings as necessary. After each regular Board meeting, the independent directors meet in executive session, outside of the presence of the Executive Chairman,CEO and management. In addition, periodically the Chief Executive Officer (“CEO”) and management.Board offers an executive session without the Board Chair, which is led by the Lead Independent Director. During the year ended December 31, 2020,2023, the Board held ten regular meetings and three special meetings. No director attended fewer than 75% of the total meetings of the Board and committees on which the director served during 2020.2023.

Committees and Committee Charters